Processing

Wheels of Fortune: The Industrious World of Coloured Gemstone Manufacturing

Introduction

In its rough and uncut form, a gemstone can resemble little more than a pebble, or perhaps a bright glint in a grey rock. Gemstone manufacturing is the process whereby a rough gemstone is transformed into a bright, radiant, geometric form. It requires an understanding of the properties of a mineral, or minerals, and of the individual characteristics of a particular gemstone. This understanding is part art, part engineering and part science. Gemstones ranging from hundreds of carats in weight to those tiny enough to fit under a fingernail can all be formed by a skilled practitioner. Those who practice this highly skilled craft are called lapidaries.

To observe a gemstone's transformation from a rough piece of stone to a glimmering and covetable jewel is to bear witness to a kind of magic. The gemstone comes to life through its transformation, offering up much the same entrancement as staring into a fire: we appreciate the flashes of contrasting colour, the movements of light and the intensity of the glints and glows that draw in the eye.

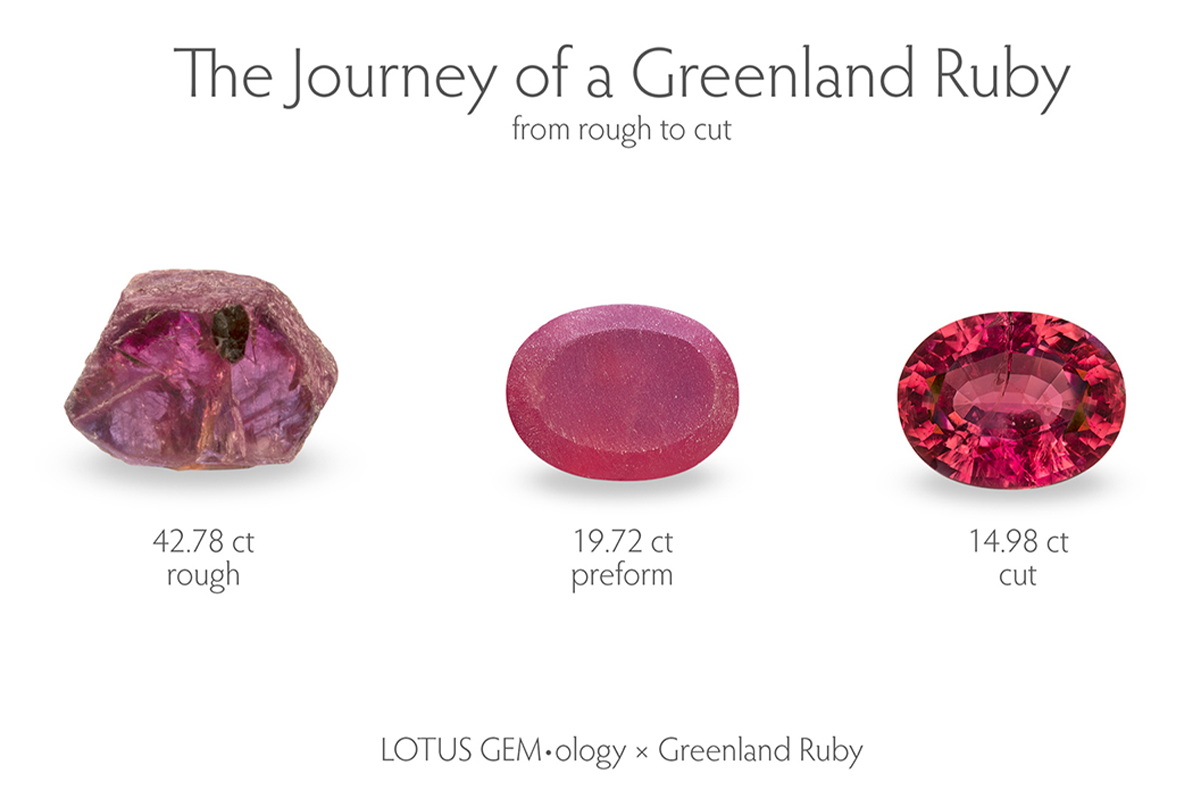

With each stage of transformation, the size of a gemstone decreases, yet its value increases - like a fine rare brandy distilled from wine. The sight of a beautiful gemstone arouses in many an intoxication that defies sense and logic.

Lapidaries constitute a vast work force, extending across almost every continent. In Sri Lanka alone they are said to number 20,0001Gemstone Cutting Industry. Accessed 2nd November 2021. https://ngja.gov.lk/gems/gemstone-faceting-industry/. Their livelihoods are important to local communities and can add considerable value to entire economies.

The lapidary process has remained largely unchanged for centuries, with skills passed down from generation to generation. For some lapidaries, who need to gain just enough knowledge to begin confidently cutting and polishing lower-value gemstones into basic shapes, training may last just a few months. Others, however, spend a lifetime becoming proficient enough in the art to be entrusted with faceting the most exceptional gemstones.

Faceting gemstones is extremely skilled work, yet often relies on relatively basic equipment, such as the grinding wheels that give this paper its title. The size and technological sophistication of a lapidary facility do not directly correspond to the quality of gemstones processed there: some of the oldest lapidary workshops, working to enhance the beauty of near-priceless, exceptionally fine gemstones, still use original 19th century equipment and techniques.

While the steps in the process of gemstone manufacturing are consistent, the knowledge and experience required for different materials, sizes and cuts varies. This variety means that for jewellers, there is no single ‘go to’ gemstone manufacturer.

Gemstone manufacture sometimes happens in highly-organised factories of up to 50 or 60 cutters, where labour is divided or specialised, but more often takes place in small workshops with between five and 15 lapidaries, and sometimes happens simply in peoples’ homes.

The coloured gemstone manufacturing industry is relatively under-studied, comparative to many other industries worldwide. This paper does not attempt to fill knowledge gaps with extensive new research. It takes the reporting that does exist on the coloured gemstone manufacturing industry, and the knowledge built up over time by the paper authors, contributors and interviewees, to map what is known about the industry, what is unknown, and what can be reasonably inferred. By doing so, the paper serves as a launching-point for those wishing to learn more about this fascinating craft, its most important social characteristics, and its place within the wider coloured gemstone sector.

Our White Papers are also available to download and read offline.

Please fill in your details to receive a download request.

The transformation of a piece of rough material into a finished gemstone consists of several stages: pre-forming, which includes evaluating the rough, sawing or grinding away structural weaknesses or flaws, and creating the “form” onto which facets will be placed; faceting, placing the many small windows by which light enters and leaves the finished gemstone onto the form according to a specific pattern; and polishing those facets to both reflect and refract light hitting the surface, entering into, passing around inside and exiting the gemstone. Oil-based, chemical, heat and even radiation treatments may be applied at various stages of transformation, to improve the appearance of the finished gemstone.

The principal stages of coloured gemstone manufacture are illustrated in the image below, made by the industrial ruby-producing company Greenland Ruby.2“Innovating the Gemstone Industry”. Greenland Ruby. Accessed 2nd November 2021. https://www.greenlandruby.gl/innovating-the-gemstone-industry/

Gemstones are innately diverse in chemical composition, physical properties and appearance. Unlike mineral deposits bearing copper, gold or other metals, gemstones deposits yield material unpredictably. Ensuring a regular supply of the most sought-after varieties, shapes and sizes is a continuous challenge, taken on daily by millions worldwide – something we explore in another paper of this series, Hands that Dig, Hands that Feed: Lives Shaped by Coloured Gemstone Mining 3"Hands that Dig, Hands that Feed”. The Gemstones and Jewellery Community Platform. Accessed 2nd November 2021. https://www.gemstones-and-jewellery.com/white_papers/hands-that-dig-hands-that-feed-lives-shaped-by-coloured-gemstone-mining/.

Before a lapidary can get to work on a coloured gemstone (or at the latest after it has been pre-formed, which we discuss below) the stone may well be “treated”. There is an array of physical and chemical treatments and enhancements that can improve the colour, clarity and durability of gemstones. Cracks can be filled with resin, thin coatings of iridescent material can be applied, and gems can be heated or even irradiated to change their colour. For example, virtually all tanzanite, which starts out as a yellowy-brown, is heat-treated to give it its famous blue colour. Gemstones that are flawless and richly coloured without treatments are very rare, and are far beyond the prices affordable for most people. The use of treatments can make colourful, beautiful stones available to a far broader array of people than otherwise, and enables the lapidary industry to derive value from large quantities of imperfect stones that might otherwise be discarded. For an exploration of the factors that shape the prices that consumers will pay for coloured gemstones, see the next paper in this series, A Storied Jewel 4The Gemstones and Jewellery Community Platform. https://www.gemstones-and-jewellery.com/research/.

Treatments vary from the widely accepted, such as heat treatment, to those that bear a stigma, such as temporarily disguising cracks by filling them with wax. As a result, one of the most important elements of the coloured gemstone supply chain is disclosure — the declaration of all the treatments applied to a gemstone, in addition to whether it is natural or lab-grown. Trying to pass off cracked, substandard gems as whole and valuable is against industry norms and in some jurisdictions is illegal – not the treatment itself, but the failure to disclose it.

When a parcel of two dozen rough sapphires arrives on the desk of a lapidary in a factory in Jaipur, India or Chanthaburi, Thailand, the stones within might not be of any standard shape or size. Individual choices must therefore be made about what type and size of cut is best. Making these choices requires a deep understanding of coloured gemstones and of the popularity of different colours and shapes in the jewellery markets of the world, and so it is usually the responsibility of a senior lapidary.

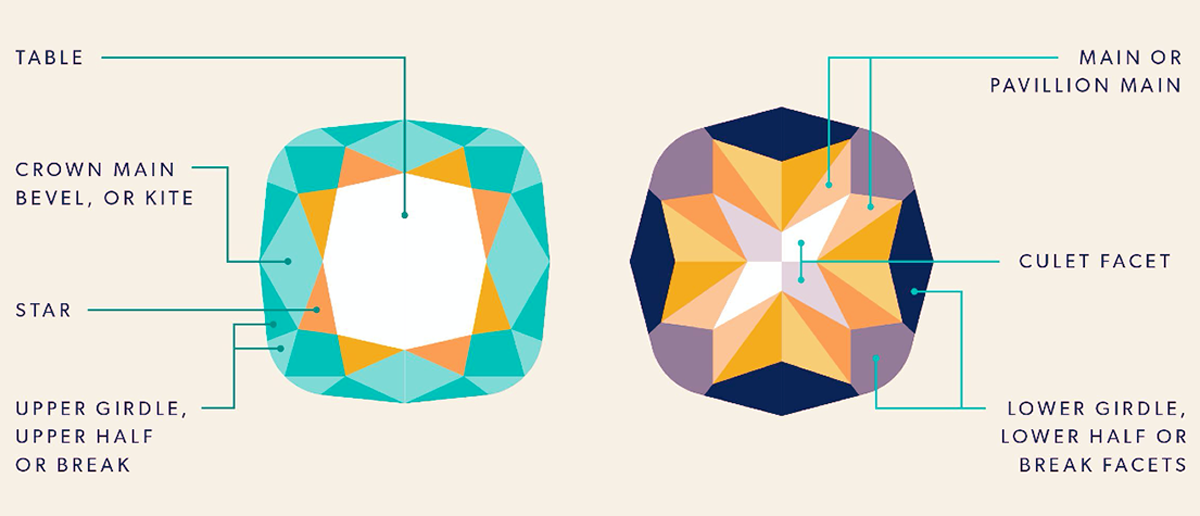

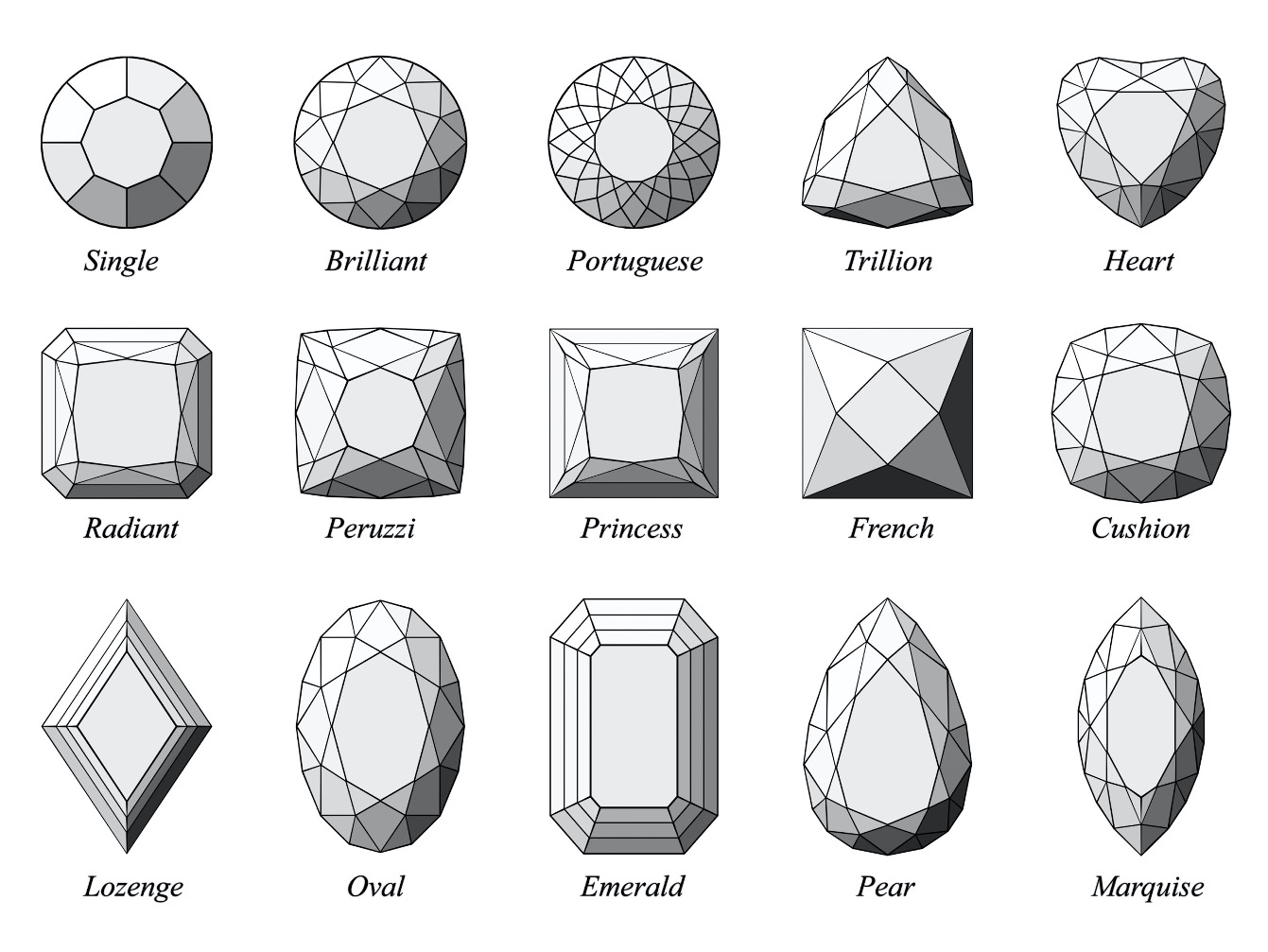

The first choice a lapidary must make is what form best suits the shape of the rough: round, oval, square, rectangle or perhaps pear-shape. Sometimes it will be immediately clear if the gems should be cut as cabochons — smooth stones with convex faces — or facetted, by cutting scores of geometrically arranged and proportioned windows, or ‘facets’, into the surface. As a rule, rarer, more transparent, less flawed and therefore more valuable gemstones are faceted, as it is a labour-intensive process, while others are cut as cabochons, because they will typically sell for a lower price and therefore merit less investment. The purpose of faceting is to create and arrange reflective surfaces in such a way that a gem optimally reflects and refracts light.

Very tiny faceted gemstones, known as melee, are used in their thousands by jewellery houses and watchmakers as accents in designs. These gemstones weigh under 0.20 carats each and are cut, often as “single cuts” (see the chart below), with a great deal of accuracy and with precise tolerances by hand.

Larger gemstones are usually used as the centrepiece of a jewellery design, while calibrated gemstones, cut to standardised dimensions weighing over 0.20 carats, may be used in pairs or sets or in collections of jewellery. The carat is a unit of weight for gemstones, with one carat equalling 0.2 grams. It is distinct from the karat, which denotes the purity of gold.

Cabochon cutting focuses on showcasing the colour or the special features of less transparent gems. One such special feature is asterism: the appearance of a “dancing” star shape on the surface of a gem, like sapphire. Gemstones that contain inclusions, sometimes referred to as flaws — imperfections like gas bubbles, crystals or internal fractures — which would disrupt the passage of light in a faceted gem, are also usually cut as cabochons or “cabbed”. Gemstones of soft material less resistant to wear also tend to be cut this way, as damage is less likely to occur to a smooth convex surface than to angular facets. Some gemstones are too compromised structurally by fractures or flaws to withstand the speeds, heats and temperatures of faceting, and are likewise cabbed. Others, such as opal, are almost always cut as cabochons because that is how their beauty is best revealed. Black opal is one of the most valuable coloured gemstones, yet its opacity means that it is most beautifully displayed as a cabochon.

Let us imagine that the lapidary in our example above earmarks half of the sapphires to be cut as cabochons. For them, the stage of choosing a cut is over. For the stones judged to be of facet grade, however, the choices are just beginning, and will become clearer after pre-forming takes place.

Gemstones of average quality, or of lower value varieties, may be given standardised cuts to match the dimensions of standard jewellery mountings.

When it comes to very fine gemstones, a difference of a few milligrams can be worth hundreds of dollars, so they are given cuts that minimise the amount of wasted material. Such gemstones will normally follow a standard cut pattern but cutters will vary the proportions and locations of facets in order to realise as much beauty and brilliance as possible.

Certain shapes of rough will naturally lend themselves to a specific form or outline, so a rough gemstone longer than it is wide might be cut in the style of an Emerald, while a more cubic or spherical piece of rough might have a variation of a Princess or a Cushion cut applied Just as in art or clothing, gemstone cuts come in and out of fashion. For instance, the Baguette cut, with long straight lines and relatively unadorned, was very popular in the 1920s and ‘30s, standing in elegant Art Deco contrast to the more florid, elaborate cuts of the nineteenth century such as the Cushion and the Portuguese.

After the cut has been decided, a gemstone is preformed. In this process a lapidary slices away waste rock with a diamond-tipped electric saw and grinds the rough gemstone into an approximation of its final shape, removing cracks and inclusions. Grinding by hand employs one of the key tools of the lapidary: a spinning disc of abrasive material, known as a lap wheel, or flat lap. Lap wheels can be made of copper, tin, steel, or even ceramic material. To this wheel might be added a suspension of diamond powder and liquid. Historically, lapidaries had to repeatedly prime their wheels with abrasive powders at every stage of cutting. But twentieth- and twenty-first-century technology has produced lap wheels that are plated with abrasive material or even sintered — that is, impregnated — with diamond powder, which improves productivity. Both cabochons and faceted gems can be pre-formed on horizontal lap wheels, but cabochons are often instead cut on vertically orientated wheels which make it easier to achieve a smooth curve.

One of the most important tasks prior to preforming is to determine the orientation of the gem. This can mean identifying bands or zones of colour, or other optical properties that vary from variety to variety, to maximise purity or dominance of the most desirable colour if more than one is evident, or the strength of that colour. The main face or “table” of a faceted stone, or the dome of a cabochon, will typically be placed to optimise these and de-emphasise any inclusions or other negative elements that might remain.

Each variety of gemstone has a refractive index, which measures the change in the speed of light as it passes through the gem material. This determines the precise geometry required for maximum return of light, refracted and reflected internally by the gemstone facets and through the table, back to the eye.

Cabochons are cut on vertical grinding wheels. Compared to faceting, it is a relatively straightforward process to form and smooth a convex surface, but practice and experience are required to achieve a consistent, symmetrical shape, efficiently time-after-time.

For faceting, extreme precision is required in the angles, pressures and orientations at which the gem is held against the grinding surface. The means used to attain this precision range from adjustable, calibrated and lockable masts or arms, to the centuries-old jamb peg — a post or pad carved with notches into which a “dop” stick with a gem attached is inserted, the position alternated for different sections of the gemstone. While it can take months to become proficient in basic faceting with a mast and cut diagrams, it takes many years to develop the expertise and finesse to facet effectively with a jamb peg without referring to cutting manuals. But once a lapidary has it mastered, they can facet gems more quickly and with more virtuosity than those more reliant on making multiple, time-consuming adjustments to a mast or arm. The time it takes to facet a single gem ranges from less than an hour to several days.

Even after facets have been cut, the gem is not ready. Next, it must be polished. The flat lap used for faceting leaves rough, translucent surfaces which hide the true brilliance of the gem, so a lapidary polishes each surface using a wheel with very fine diamond powder. Cabochons must be polished too, and these stones are most often polished using wheels made of felt, coated with gentle abrasives.

Once one of the sapphires that landed on the lapidary’s desk at the start of this story has been pre-formed, faceted and polished, it will likely resemble the sparkling gemstone of the general imagination: brilliantly shining, transparent and richly colourful.

What is clear when examining the process of gemstone manufacturing is the depth and breadth of the skills involved, and the level of judgement required.

The profusion of techniques, styles and materials means that you could take at random a hundred lapidaries with a decade of experience each and not find a single pair with identical expertise. One might have spent a career cutting Australian black opal into cabochons; another might re-facet damaged antique rubies for use in modern jewellery; and a third might exclusively cut round brilliant sapphires. In the 21st century this immense diversity and plurality in what is, in many ways, simply a light-manufacturing industry, seems almost quaint. However, the romantic image of a master who works by hand and has spent decades accruing unique expertise is not the whole truth; it disregards the drive for standardisation, efficiency and, where possible, profitable and desirable, the automation that is central to modern manufacturing.

The progression from crude repurposed millwheels to powder-coated copper laps to high-tech sintered steel-and-diamond wheels illustrates the march of technology clearly. Just as striking is the historical shift from freehand cutting to jamb pegs and then to angle-manipulation equipment that allows the precise calibration of almost every variable. Once that level of formulaic input is possible, one might be tempted to imagine the next step will be to write software to enable machines to cut and polish gemstones, removing the human touch completely.

For a long time, gem processing defied the typical patterns of standardisation and automation that affected other previously artisanal industries. While automation revolutionised manufacturing in countless sectors, the diversity of techniques and the lack of standardised gem material meant that the lapidary industry stayed largely the same.

There are signs that this has begun to change because of rising labour costs and a lack of new entrants leading to a skills shortage; coupled with improvements and innovation in available technology. Understanding the role of technology and automation is key to understanding the challenges and opportunities facing the lapidary industry in the coming years.

Mechanised, motorised cutting has been around since the 1930s. Electric grinders, lapidary wheels, faceting machines, tumble polishers and bead machines make the processes considerably less strenuous and more efficient than hand-cranked or foot-pedalled machines. Machines can also provide the precision needed for certain cuts and for calibrating sizes and proportions. However, recent technological advancements have extended the possibilities even further.

In the 21st century, advances in scanning technology, adapted from the diamond industry, and the development of artificial intelligence5“A hybrid artificial intelligence approach for improving yield in precious stone manufacturing”. Holden, T., Serearuno, M. Journal of Intelligent Manufacturing, Manuf 16, 21–38 (2005). February 2005. Accessed 2nd November 2021. https://doi.org/10.1007/s10845-005-4822-8 to accurately grade rough gemstones mean that computers can now analyse and map flaws in individual stones and devise cuts that give optimal yields. This technology has so far has not been scaled to commercial levels, and tends to be restricted to use with high-value stones.

Advancements were made in 2005-11 by the Fraunhoefer Institute for Industrial Mathematics and industrial partners Paul Wild GmbH in Germany and Hexagon Manufacturing Intelligence, United Kingdom, with rough scanning and gem-cutting software for CNC (computer numerical control) machines that were proven faster, more accurate and more efficient than humans cutting mêlée emerald, ruby and Paraiba tourmaline in under 0.20 carat sizes. All are high value varieties in demand for use in the global watch and jewellery-making industry6“Precise cut for sparkling jewels using automated gem cutting machine”, Fraunhofer-Gesellschaft, Science Daily. 11th April, 2008. Accessed 2nd November 2021. https://www.sciencedaily.com/releases/2008/04/080408102835.htm.

People, by contrast, are more intuitive and adaptive than machines, and can learn and transfer subtle skills that allow them to adapt to new types of gems and cuts, take non-standardised input material and create non-standardised outputs. Once the fundamental principles of cutting and faceting are mastered, they can be applied to almost any gem type or shape

Where cheap, skilled labour is available, there is less incentive for investment in the latest technology. The set-up cost in automation is high, especially relative to the profit that can be gleaned from lower-value gems. In regions with less-developed infrastructure, the frequency of power outages forces greater reliance on human labour too.

Justin Prim, a gemmologist, lapidary and historian of the industry who was interviewed for this paper, believes that new lapidary technologies will develop in parallel with existing techniques:

“I think it’s safe to say that the old and the new ways will continue to co-exist for a long time. Exporting American-made innovations has proved to be much more expensive than buying locally made traditional copper and tin laps, so I think the gem industry will make do with what it can get the easiest and cheapest7“Lapidary Technology Through the Ages”. Medium. Accessed 2nd November 2021. https://medium.com/justin-k-prim/lapidary-technology-through-the-ages-laps-and-polish-59c29f05a11a.”

Many industries are experiencing a resistance to automation, as people fear the loss of livelihood that could result. For unskilled workers in low-income countries with few alternatives, this loss can be devastating. For some in the lapidary sector, such concerns can loom large.

Upsides of automation for the lapidary sector may also exist. For example, where there is a desire to develop a lapidary industry but insufficient skilled lapidaries, or where the number of lapidaries in an established gem processing hub is dwindling, and the resultant skills gap must be closed8“Gem sector faces labour shortage”. JNA Special Feature, January 8, 2012. Accessed 2nd November 2021. https://www.jewellerynet.com/en/magazine/features/1368.

We pick up these themes later in the paper. First, we explore where gemstone cutting takes place and why.

The Economics of Gemstone Clusters

The lapidary industry is not spread evenly across the world. Numerous factors mean that, at any point in history, the majority of gemstone manufacturing has taken place in a handful of key locations, or “clusters”.

Cluster economics, usually referring to manufacturing and high technology industry, was first discussed by name in the 1990s by Michael Porter. Beginning in the book The Competitive Advantage of Nations9“The Competitive Advantage of Nations”. Michael Porter. Free Press. 1990., Porter observed that the world economy is dominated by ‘clusters’ — dense geographic concentrations of businesses and institutions in the same field, like technology firms in Silicon Valley or the motor industry in Detroit — and argued, to briefly paraphrase, that this happened because the advantages that businesses derive from being in close proximity to their competitors — such as innovation, shared infrastructure, and economies of scale — outweigh the benefits of setting up shop in relative isolation.

In line with Porter’s thinking, there is a pattern in the lapidary industry of densely packed clusters of gemstone manufacturing, and related businesses and organisations that foster intense competition, innovation and expertise. These are frequently interlinked, through infrastructure, vertical integration, and public and private institutions. Such clusters tend to be found in international gemstone trading hubs. Over the last few centuries, hubs could be found in Britain, the Netherlands, France and Germany. Now, the key hubs are in China, India, Sri Lanka and Thailand. The vast majority of the world’s gemstone manufacturing currently takes place in these four countries.

In China, India, Sri Lanka and Thailand hundreds, if not thousands, of lapidary businesses compete with one another, without merging and consolidating in ways that would stifle the diversity and vibrancy of the industry. Rather, this competition fosters innovating and learning. The nature of gem cutting is such that no one person could ever hope to master every type of cut for every type of gem. This gives the industry a rich complexity, with different firms in different trading-manufacturing hubs specialising in different gemstone varieties, qualities, sizes, cuts and serving different segments of the market.

One of the advantages of clustering is that all the experts are in one place, which means that anyone can bring rough gems to such a cluster and be confident that, regardless of the material, someone there will know how to cut the gems in the way the person wants. Moreover, other services and supplies will be available to support further value-addition, like jewellery manufacture and gemstone setting, on a gemstone’s journey towards retail.

The gem cutting and jewellery manufacturing centres of Thailand, India, Sri Lanka and China did not attain their pre-eminence suddenly, nor was it a matter of chance that they arose where they did. The fact that Southeast Asia is now overwhelmingly the place that traders and jewellers go to get gemstones cut and polished is the result of centuries of crafting knowledge, the shift in the global economy from West to East, cheap skilled labour, good infrastructure, favourable tax regimes and financial incentives, and the combination of historical regional abundances of gem deposits and fortuitous positions on major trade routes. But even these factors do not tell the whole story. Having been established for (at the least) several decades, Asia’s lapidary centres have developed into effective cluster economies, in which the dense web of skills, relationships, supply chains and complementary industries compound the effects of those factors to make the lapidary industry much more than the sum of its parts. Such institutional flexibility and depth has taken time to develop.

Each of the four South-East Asian gem processing hubs — China, India, Sri Lanka and Thailand — has its particular specialisations, such as expertise in particular minerals, or in treating or grading gems. In addition, some hubs offer other kinds of value-adding services, such as low-cost, bulk-order jewellery manufacture.

In China, the chief coloured gemstone cutting and trading cluster is in Guangzhou. From here goods are exported via Hong Kong. Panyu, one of Guangzhou’s districts, has more than 1,600 gem cutting factories employing around 20,000 lapidaries10“Panyu: A legendary manufacturing hub for the global gem and jewellery industry”. Gemological Institute of America. Accessed 2nd November 2021. https://www.gia.edu/UK-EN/gia-news-research/panyu-legendary-manufacturing-hub-for-the-global-gem-and-jewelry-industry. China exported $99 million in coloured gemstones in 201911OEC Precious Stones. Accessed on 2nd November 2021. https://oec.world/en/profile/hs92/precious-stones.

The industry’s success and rapid growth can be attributed to extremely low labour costs and strong government support — although recently, labour costs have risen as companies compete for skilled, specialised workers. This has put pressure on profit margins but has also supported growing domestic demand totalling $92 billion for jewellery overall in 201912“China's Diamond Market on Path to Recovery”. Rapaport Diamonds. Accessed 2nd November 2021. https://www.diamonds.net/news/NewsItem.aspx?ArticleID=66085. China is the world’s top consumer of jewellery by retail sales value followed by India, United States and Japan.

Guangzhou uses a blend of technologies, relying less on lapidaries working by hand with jamb pegs than the other hubs. Its rapid growth has been supported by the widespread uptake of semi- and full-automation technology13Interview with David Epstein, Precious Resources Ltda, Brazil, for this paper 28th September 2021.. China excels in semi-precious and synthetic stone manufacturing and production where margins tend to be smaller and tighter.

In India, the “Pink City” of Jaipur is world-renowned for its emerald, tanzanite and wider coloured gemstone industry. It is also synonymous with colourful crafts – famed for jewellery artistry that includes enamelling (ground-up, coloured glass paste, baked onto the surface of metal) and gemstone setting. Traditionally, Jaipuri craftsmen and lapidaries served Maharajas, creating unique, high-value jewellery using specially cut gemstones. By contrast, these days, Jaipuri craftsmen more often make relatively inexpensive, mass-produced jewellery using calibrated gemstones, serving domestic and international markets for affordable jewellery, which grew in the second half of the twentieth century buttressed by a growing middle-class, consumer credit, the rise of television shopping channels and a profusion of retailers in the USA, UK and Japan14“Jaipur, India: The Global Gem and Jewelry Power of the Pink City”, Andrew Lucas, Nirupa Bhatt, Manoj Singhania, Kashish Sachdeva, Tao Hsu, and Pedro Padua , GIA Gems & Gemology, Winter 2016 Vol.52 No.4.

https://www.gia.edu/gems-gemology/winter-2016-jaipur-india.

In 2019 India exported approximately $25 billion in precious metals, gemstones and jewellery, $591 million in coloured gemstones; the domestic jewellery market was valued at around $89bn15“Gem and Jewellery Export in August Crosses Pre-pandemic Level”. The Economic Times. Accessed 2nd November 2021. https://economictimes.indiatimes.com/industry/cons-products/fashion-/-cosmetics-/-jewellery/gems-and-jewellery-export-in-august-crosses-pre-pandemic-level/articleshow/86579504.cms?from=mdr.

Sri Lanka is renowned for producing some of the finest coloured gemstones, the most famous of which is the eponymous Ceylon sapphire. The government recently announced financial and tax reforms in order to strengthen the sector’s competitiveness, which has been steadily losing ground to East Asian clusters16“Gem, Diamond and Jewellery Exports Double”. Daily FT. Accessed 2nd November 2021. https://www.ft.lk/top-story/Gem-diamond-and-jewellery-exports-double/26-720765. In spite of fierce competition, Sri Lankan lapidaries possess a virtual monopoly importing rough sapphires from around the world. It also remains one of the world’s top five gemstone mining countries. In 2019 Sri Lanka exported approximately $306 million in coloured gemstones.

Sri Lanka’s technical flexibility is exemplified in the way that many workshops employ both traditional craftsmen and lapidaries trained in modern techniques. The latter use high-precision, motorised faceting machines to produce exquisitely cut gemstones, which the former then polish using simpler bow-driven hanaporuwa machines, which have been used for centuries and do not rely on electricity17“Cutting Precious Stones on the Island of Gems”. Justin Prim. Medium. 8th April 2019. Accessed 2nd November 2021. https://medium.com/justin-k-prim/the-modern-history-of-gemstone-faceting-in-sri-lanka-c394a5a504c3.

A craftsman using a traditional hanaporuwa in Ratnapura, Sri Lanka.

Image: Alamy

Thailand is the global epicentre for ruby manufacturing. It is renowned not just for gem cutting and trading, but also for pioneering ruby treatments and building a thriving gem and jewellery community, that generated $15 billion in jewellery and gemstone exports in 2019, including $1.2 billion in coloured gemstones18“Gems and Jewellery Exports Dazzle in 2019”. National Thailand. Accessed 2nd November 2021. https://www.nationthailand.com/in-focus/30380528.

In 1962 when Myanmar’s ruby mines were nationalised after a military coup, the international jewellery industry faced ruby shortages. Industry attention turned to Thailand, which had once been a major ruby producer in its own right. As global demand exploded, driven initially by Western consumers, the country revived centuries of ruby expertise to develop treatments to improve substandard ruby material and keep the ruby-cutting industry alive, despite Myanmar’s temporary absence from international trade19“A study of rubies from Cambodia and Thailand”. Gemological Institute of America. 7th August 2017. Accessed 2nd November 2021. https://www.gia.edu/gia-news-research/study-rubies-cambodia-thailand and “Thailand: The undisputed ruby trading Kingdom: A Brief History”. Vincent Pardieu, InColor Spring 2019 (Issue 42). Accessed 2nd November 2021. https://www.researchgate.net/publication/339439253_Thailand_the_undisputed_ruby_trading_kingdom_a_brief_history.

Although South and East Asia’s gem processing industries are robust and consumer demand in the region is strong and growing, its known gemstone deposits are in decline and new discoveries are being made in other parts of the world. Afghanistan, Pakistan and East Africa, for instance, are experiencing gem mining booms and are increasingly important sources of coloured gemstones.

But no matter how precious their jewels or the low cost of their labour, these places miss out on a large proportion of the value of their gemstone deposits because they do not have well-developed value-addition capacity in the form of lapidary industries.

Significant efforts have been undertaken in recent years to remedy this situation, though their success so far has been limited. We explore two case studies in this section, examining some of the underlying obstacles that have held back laudable initiatives from reaching their full potential, to see what lessons can be learned for the future.

Tanzania

There are currently 650-700 lapidaries in Tanzania, mostly clustered in the gemstone market city of Arusha. In 2019, Tanzania exported $77 million in coloured gemstones20OEC Precious Stones. Accessed 2nd November 2021. https://oec.world/en/profile/hs92/precious-stones?yearSelector1=tradeYear1 .

In early 2010 the Parliament of Tanzania took a decision to ban export of rough tanzanite, to drive the development of a domestic cutting and polishing industry. The legislation also contained a range of other provisions to boost local involvement and entrepreneurship in the coloured gemstone sector. The rough export ban was extended to other varieties of gemstone in April 2017, then scaled back in 2019 to cover only the higher-value gemstone types, and weights over 10 carats21“State of the Colored Stone Market: Building Benefits at Home”. National Jeweler. Accessed 2nd November 2021.https://www.nationaljeweler.com/articles/6288-state-of-the-colored-stone-market-building-benefits-at-home.

Critics of the legislation pointed to a lack of domestic lapidary capacity, arguing that gemstones which could not be processed locally would simply be exported illegally. Indeed, the law led to a marked drop in tax receipts from tanzanite exports22“Tanzania's Wasted Tanzanite”. AA. Accessed 2nd November 2021. https://www.aa.com.tr/en/economy/tanzanias-wasted-tanzanite/99694.

A Jaipur-based gemstone cutter, Jagdish Tambi, said at the time to an industry magazine that “the Tanzania government is expecting to get employment there but currently it is not possible to cut and polish the gemstone in Tanzania. The Tanzanite One sight holders [established buyers at Tanzania’s principal large-scale tanzanite mine] would be benefited from this as the company has a license to export and the new laws are not applicable to them. But this would definitely create a shortage of raw material, which is already tough to procure23“New Mining and Rough Gemstone Export Legislation Passed in Tanzania”. Diamond World. Accessed 2nd November 2021. https://www.diamondworld.net/contentview.aspx?item=4889.”

Peter Periera, a gemstone dealer and the operator of a cutting centre commented to the industry press in 2019 that Tanzania’s cutting sector was not established enough to handle the material on the market. “They’re not yet capable of cutting all the material that we require. We’re a long way out. It’s impossible at the moment,” he said24“State of the Colored Stone Market: Building Benefits at Home”. National Jeweler. Accessed 2nd November 2021. https://www.nationaljeweler.com/articles/6288-state-of-the-colored-stone-market-building-benefits-at-home.

Some commentators saw growth potential in the domestic lapidary industry, despite current capacity shortfalls. One foreign lapidary who regularly buys in Tanzania, Roger Dery, commented in the same article that “10 years from now, if they have another 600-800 gem cutters who are trained on modern machines, I think you’re going to have an escalation in revenue and people choosing that location as a place not just to buy, but a place to take their goods to be cut25Ibid..”

Madagascar

Madagascar reported $135 million in coloured gemstone exports in 201926OEC Precious Stones. Accessed 2nd November 2021. https://oec.world/en/profile/hs92/precious-stones?yearSelector1=tradeYear1.

The Institut de Gemmologie de Madagascar in Antananarivo received seed funding over 10 years ago from the World Bank and continues to operate. In addition to teaching lapidary, gemmology, and the making of costume jewellery, the Institute also has a gem testing laboratory.

Malagasy cutters trained at the Institut de Gemmologie reportedly cut well. According to Gemmological Association of Great Britain’s (Gem-A) Barbara Kolator: “Lapidary courses are offered at the Institute in addition to Gem-A Foundation and Diploma courses. The standard is very high and I was very impressed by the quality of stones that were cut, especially at the Master level27“Field Trip: A Visit to Gem-A ATC Institut de Gemmologie de Madagascar”. The Gemological Association of Great Britain. Accessed 2nd November 2021. https://gem-a.com/gem-hub/around-the-world/institut-gemmologie-madagascar-gemmology.”

However, “there is no calibrated cutting industry. The Malagasy won’t work for the wages paid in Jaipur or Surat”, according to Tom Cushman, an international dealer based in Madagascar, who drove establishment, set up and growth of the centre. “Large-scale factories like in China or Korea or even Thailand require a large investment and a steady stream of material to operate. Both items are not dependably found in Madagascar.”

When asked about local trading and value addition hubs he said: “I do not think a trade hub is ever a good idea unless it is very near the sources of production. Miners are not going to spend time and money to travel to a central site to sell their goods for the same price a dealer will pay them at the source. The miners and local dealers at the sources get all the market will bear as there is a strong buyer-buyer competition to get the good stones. The buyer that pays the most gets the goods. The final buyers at the source areas export internationally and don’t have any desire to sell in a local hub. Of course, the exporter to international trade centres makes a profit too but they also provide a service and added value28Correspondence with Tom Cushman. September/October 2021.”

Razafiasimbola Hanita, a lapidary in Madagascar, holds a quartz “sugarloaf”29Correspondence with Lynda Lawson, 5th June 2020.. Image: Lynda Lawson

Looking to the future

The examples of Tanzania and Madagascar indicate some important characteristics required for the success of a gemstone manufacturing hub: the hub should be geographically well located, near mining areas; supporting regulation should be implementable, incentivizing and not easily circumvented by smuggling; sufficient skilled workers should be attracted to the hub; and the hub should have a clear financial advantage for traders, compared to exporting gemstones rough.

The former two characteristics, good location and strong regulation, can be established through careful planning. The latter two characteristics, skilled workers and a financial rationale, are less easy to bring about through planning alone. As discussed in earlier sections of this paper, The economics of gemstone clusters and Lapidary clusters in the present day, the establishment of a viable cluster of skilled workers, with sufficiently diverse expertise to attract a broad range of clients, is not straightforward. It depends on a great many social and economic factors, and in many cases, clusters evolve over decades, if not centuries.

Laudable value-addition initiatives for coloured gemstones are underway in Kenya, Afghanistan, Ethiopia, Nigeria, Pakistan and other countries, in addition to Tanzania and Madagascar. If they are to succeed, they must be supported holistically, paying attention to all the factors that can help a viable gemstone manufacturing cluster to grow, and to compete with its international peers. One-off training programmes in lapidary skills are valuable, but will not be sufficient. Should it be found, after careful study, that any planned coloured gemstone manufacturing hub is not commercially viable, development resources may be better spent on other initiatives for poverty alleviation and economic empowerment, in order to best serve the people of coloured gemstone-producing countries.

In each of the Southeast Asian gem processing hubs it is possible to have a rough gemstone cut, polished and set in a piece of jewellery, the export papers prepared and the customs declarations signed, in a relatively easy, efficient and streamlined process. This ease is due to cluster economics, and to the favourable governance environment that both facilitates business and allows clusters to evolve and sustain themselves.

Considering these factors, and the changing geographic frontiers of coloured gemstone mining, manufacturing may shift towards Dubai in future, where the conditions are ripe for the development of a coloured gemstone cluster. A handful of gemstone, diamond and jewellery manufacturing firms are already pioneering business there. The International Coloured Gemstone Association (ICA), held its annual congress there in 2007. "Dubai has created an environment for the gem industry to take advantage of. The potential is enormous. Coloured gemstones are a beautiful commodity, which is underutilised here. There is not a lot of knowledge," Andrew Cody, then head of the ICA, told Gulf News at the time. He added the removal of Dubai’s five per cent customs duty on gems imports would boost the trade. "We see lowering of taxes from five per cent to zero to be important30“Dubai Could Become Major Centre for Gem Trade”. Gulf News. Accessed 2nd November 2021. https://gulfnews.com/business/markets/dubai-could-become-major-centre-for-gem-trade-1.177579."

India’s Gem & Jewellery Export Promotion Council (GJEPC) organised the inaugural International Gem & Jewellery Show (IGJS), an in-person exhibition, in Dubai in August 2021. The Middle East is one of India’s biggest gem and jewellery markets, accounting for 40% of total exports31“India's GJEPC to organise International Gem & Jewellery Show IGJS in Dubai from August 14-16”. Jewellery Outlook. Accessed 2nd November 2021. https://jewelleryoutlook.com/indias-gjepc-to-organise-international-gem-jewellery-show-igjs-in-dubai-from-august-14-16/.

The United Arab Emirates (UAE), of which Dubai is but one, exported $276 million in coloured gemstones in 2019.

Health, Safety, Labour and Gender in Gemstone Manufacturing

Coloured gemstone manufacturing adds value in the billions of dollars globally and employs hundreds of thousands of people worldwide. It takes place at major international hubs and competition between and within them is fierce. There are smaller and emerging hubs, and hubs that have not yet reached their potential. There is a skills shortage worldwide. This is particularly evident in emerging mining regions and producer countries keen to capture a greater share of the value of gemstones domestically, as we learned in the case of east Africa earlier.

Manufacturing workers can be exposed to health risks peculiar to gemstone cutting, notably silicosis, when proper precautions are not taken, and in some cases, risks related to informal labour. In this section we look at some key social aspects of coloured gemstone manufacturing, and explore similarities and differences with other industries.

The workshops where coloured gemstone manufacturing happens tend to be small compared with those in mass production industries. Industrial-scale, densely packed factories producing high-volume, low-value goods are rare in this segment of the market. Unskilled labour is not a feature, and experience and judgement are at a premium. Coloured gemstone manufacture is still a craft, mostly done by hand, and does not lend itself to conveyor-belt processes.

The sector is characterised by its variety of workplaces, from high-tech gemstone processing factories filled with world-class equipment, such as Swarovski’s Bangkok factory, to people cutting gemstones with more rudimentary tools in small private workshops. It is problematic, therefore, to generalise or attempt to draw a picture that portrays typical working conditions across the entire lapidary industry, especially as no one has studied the sector in detail.

There can be workplace problems, of course. Below we describe some high-profile poor social and workplace conditions that have been known to occur when management of factories and workshops is weak. This is not an exhaustive list. We aim to give a balanced view of how they might be present in some parts of the industry, but we do not imply that they are widespread, or attempt to quantify the scale of incidences.

We note too that the industry has a growing track record in responding when poor conditions come to light. Consumer-facing brands complete supply-chain assessments and audits and work with their suppliers in line with responsible sourcing guidelines, such as those produced by organisations like the Responsible Jewellery Council and the Gemstone and Jewellery Community Platform.

Livelihoods Afforded by Coloured Gemstone Manufacturing

The work of a lapidary is highly skilled, as we have shown. These skills are in demand. In fact, there is generally believed to be a global shortage of qualified lapidaries, one reason why pay is above average and competition for the best is fierce.

Wages vary, between and within countries as in any other industry, in-line with national living and average wages and levels of experience. In Jaipur, in India (the largest lapidary cluster by number of workers, with an estimated 150,000 people directly employed by the sector32“Jaipur, India: The Global Gem and Jewelry Power of the Pink City”. GIA Research News. Accessed 2nd November 2021 https://www.gia.edu/gems-gemology/winter-2016-jaipur-india), an average annual wage range of between $2,400-$5,500 was reported in an interview with a workshop owner conducted for this paper33Stakeholder interview Mahmoud Allam Mahsood, Fine Cut Lapidary, Pakistan, 24th May 2019.. By comparison, the minimum wage for an unskilled worker is $3 per day34“Wages of Unskilled Labour Has Been Increased to Rs 213 from Rs 207” “Raje hikes minimum labour wages by Rs 6, cites inflation”. Hindustan Times correspondent, Hindustan Times. 6th June 2018. Accessed 2nd November 2021. https://www.hindustantimes.com/jaipur/raje-hikes-minimum-labour-wages-by-rs-6-cites-inflation/story-EHpM05PJuNi2VHGJP3qdxK.html. In Sri Lanka and Thailand gem cutters tend to earn more than standard worker wages too.

In key clusters such as Guangzhou, the lapidary industry began developing as recently as the 1980s and was driven by a rapidly industrialising economy and strong government support. As a result, virtually all Chinese lapidaries are graduates who work in sophisticated factories for competitive wages. Such is the competition that some employers claim wages have risen 15 per cent each year for the past several years35“Panyu: A Legendary Manufacturing Hub for the Global Gem and Jewelry Industry”. Tao Hsu and Andrew Lucas, GIA Research News. 2nd July 2015. Accessed 2nd November 2021. https://www.gia.edu/gia-news-research/panyu-legendary-manufacturing-hub-global-gem-jewelry-industry..

Labour Rights

There is very little public reporting of severe labour rights abuses – such as worker exploitation, forced labour and harmful child labour – in the coloured gemstone manufacturing industry. In this section, we assess the possibility that such practices do occur on a significant scale, despite a lack of public reporting on them.

Some characteristics of certain parts of the gemstone manufacturing industry are generally recognised as risk factors for labour rights violations. Principal among these is informality.

Informal labour is common in the gemstone manufacturing industry, particularly in India. Manufacturing capacity must expand and contract at different times of the year, and freelancing is not uncommon. Workshops might retain a core team, augmented with more casual cutters and polishers who also supplement their incomes in other ways. This can make labour rights hard to oversee and enforce, for the responsible authorities.

The presence of informal labour can make labour rights violations more likely, but it is not a certain sign that violations take place. Informal labour is common in Europe and the United States, where it is sometimes called the ‘gig economy’, and it is largely free of the most severe forms of worker abuse. Other risk factors must also be considered.

India, and other countries with gemstone manufacturing clusters, score poorly for labour rights enforcement in respected international indices. The International Trade Union Confederation Global Rights Index 202136Global Rights Index 2021. Accessed 2nd November 2021. https://www.globalrightsindex.org/en/2021/countries, for example, scores India, China and Thailand “5” (the second-worst category out of six, indicating that workers have no guarantee of rights), and Sri Lanka “4” (the third-worst category out of six, indicating that workers’ rights are systematically violated37ITUC Global Rights Index Description of Ratings. Accessed on 2nd November 2021. https://survey.ituc-csi.org/IMG/pdf/description_of_ratings.pdf).

A 2011 census found that there were 10.1 million child labourers in India38“World Day Against Child Labour: An Overview of the Current Situation in India”. India Today. Accessed on 2nd November 2021. https://www.indiatoday.in/education-today/gk-current-affairs/story/world-day-against-child-labour-india-global-statistics-1547177-2019-06-12, fifty thousand of whom were in the gemstone hub of Jaipur. The US Department of Labor reports that in Sri Lanka 21.9% of the country’s 28,515 child labourers work in “Industry”39“Child Labour in Sri Lanka - At a Glance”. International Labor Organisation. 29th January 2018. Accessed on 2nd November 2021. https://www.ilo.org/wcmsp5/groups/public/---asia/---ro-bangkok/---ilo-colombo/documents/publication/wcms_616216.pdf. In China, 7.74% of children aged ten to fifteen were working in 201040“Child Labour in China”. Can Tang, Liqiu Zhao, Zhong Zhao. “China Economic Review”, Vol. 51, October 2018, pp.149-166. Accessed on 2nd November 2021.

https://www.sciencedirect.com/science/article/pii/S1043951X1630061X. In Thailand in 2015, 2.9% of children aged 5-17 were involved in child labour41“Child Rights and Business Guidance for Chinese Companies Operating in Thailand”. UNICEF. Accessed 2nd November 2021. https://www.unicef.cn/en/csr/thailand.

Notwithstanding these risk factors – informality in gemstone manufacturing, and weak enforcement of worker rights and child labour prevalence in countries with gemstone clusters – the picture for coloured gemstones is not dire. Another crucial risk factor for labour rights abuses is low-skilled employment42“Low-Skilled Labor Shortages Contribute to Forced Labor – Evidence From Myanmar and Thailand”. Joann F. de Zegher. Accessed 2nd November 2021. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3899489, and this does not match the specialised, expertise-heavy gemstone manufacturing industry. Labour rights abuses are most often associated with goods produced in high volume at low cost, such as apparel and consumer electronics43“Were Humans Harmed in the Making of Your Shiny Gadget?”. Lucy Siegle, The Guardian. 1st May 2011. Accessed 2nd November 2021.

https://www.theguardian.com/commentisfree/2011/may/01/lucy-siegle-human-cost-consumerism.

The small amount of evidence that is available appears to support a thesis that labour rights abuses are less prevalent in coloured gemstone manufacturing than in many other industries.

For example, a 2014 Al Jazeera investigation alleges “rampant” child exploitation in the “Jaipur gem industry”, including 15-hour work days and chemical exposure. However, when describing the child labour undertaken, it quotes a local human rights organisation that described “minors sticking jewels in bangles” in a three-storey factory. The article does not differentiate between the manufacturing of low-cost mass-produced jewellery for the local market and high-end gemstones for onward international trade44“Indian Children Toil in Jaipur Gem Industry”. Al Jazeera. Accessed 2nd November 2021. https://www.aljazeera.com/features/2014/3/12/indian-children-toil-in-jaipur-gem-industry.

When contacted for this paper, the Washington-based Freedom Fund, a leading anti-slavery organisation, relayed regarding its work in India that “our project focuses almost all on children working on bangle making, embroidery and other handicrafts, and very little on children working on gemstones45Deepika Reddy Allana, Program Manager, Washington, DC, The Freedom Fund, email correspondence 22nd September 2021.”. This organisational focus could indicate a perceived lower risk of child labour in gemstone manufacturing.

Instances of severe labour rights abuses undoubtedly exist in coloured gemstone manufacturing, as in any industry, but the available evidence suggests that such problems are not widespread.

Like in many other sectors, there are industry-led initiatives covering coloured gemstones that aim to ensure labour rights are upheld and severe abuses are eliminated from supply chains. Many companies in the coloured gemstone supply chain are acutely aware of the need for strict standards, to maintain the reputation of the sector. The Gemstones and Jewellery Community Platform46The Gemstones and Jewellery Community Platform. https://www.gemstones-and-jewellery.com/ provides companies with a range of training resources on eliminating child labour and forced labour, alongside model policies and procedures for companies to adopt. The Responsible Jewellery Council publishes and maintains a Code of Practices for the jewellery industry that covers both child labour47Child Labour RJC Guidance. Accessed 2nd November 2021. https://www.responsiblejewellery.com/app/uploads/Child-Labour-RJC-Guidance-draftv1.pdf and forced labour48RJC Standards Guide. Accessed 2nd November 2021. https://www.responsiblejewellery.com/app/uploads/RJC_Standards_Guidance_2013_eng_Provision_18.pdf.

Health Hazards and Silicosis

Like any light manufacturing industry, coloured gemstone manufacturing can present health and safety risks, if not well-managed. Wherever machinery is involved, there is risk. Unsafe wiring, poor or non-existent fire safety protocols and improper use of equipment can all pose a danger to people.

Such risks are generally minimised with proper training, maintenance and well thought-out and communicated safety measures and practices.

In addition to general manufacturing risks, there are some dangers that are particular to parts of the gemstone manufacturing industry. The most prominent is silicosis - a condition in which long-term exposure to silica dust can cause respiratory disease. Silicosis is progressive, incurable, and almost always fatal. Because it is caused by dust inhalation it can be developed by anyone in the vicinity of a dust source, not just workers.

Silicosis rose to prominence for the jewellery industry from 2005 onward, with the publication of Deadly Dust, an investigation into silicosis disease in gemstone cutters in Guangdong, China49“Deadly Dust”. China Labour Bulletin. Accessed 2nd November 2021. http://gb.clb.org.hk/content/deadly-dust. The report was published by the Hong Kong-based China Labour Bulletin (CLB), an organisation that “supports and actively engages with the emergent workers’ movement in China50“About Us”. China Labour Bulletin website. Accessed 2nd November 2021.

https://clb.org.hk/content/about-us-0”.

CIBJO president Gaetano Cavalieri gave the report exposure, commenting at the time that “addressing issues of this nature lies at the core of CIBJO’s purpose, and once again demonstrates our organization’s commitment to involve itself in each and every issue that affects consumer confidence in jewellery products,” and appealing to the authorities to investigate and address identified health impacts51“CIBJO draws attention to Silicosis in Guangdong”. Diamond World News Service. 20th Dec 2005. Accessed 2nd November 2021 https://www.diamondworld.net/contentview.aspx?item=178

.

Silicosis risk is restricted to a small number of gemstone types, in which silica crystals are present. A 2019 report by Workplace Health Without Borders identifies these as quartz (including agate) chalcedony and amethyst52“Jaipur Project: Coloured Gemstones Processing- A Pilot Study for Worker Health Issues and Interventions”. On behalf of WHWB; Paul Bozek, Lissa Ceolin, Marianne Levitsky, Om Malik, Sid Gohil. Prepared for American Gem Trade Association. 8th March 2019. Accessed 2nd November 2021. https://static1.squarespace.com/static/568a3352e0327c02e38c3369/t/5d2062f3397b46000194c322/1562403576448/WHWB+Jaipur+report+8mar2019+final+%281%29.pdf. A 2016 report by the Times of India identified agate as the main stone type associated with silicosis in Khambhat region53“US trade body to help combat silicosis among gem workers”. The Times of India. 1stJuly 2016. https://timesofindia.indiatimes.com/city/surat/us-trade-body-to-help-combat-silicosis-among-gem-workers/articleshow/52999871.cms, In South Africa, a 1991 study linked local incidences of silicosis to amethyst and various types of quartz54“Silicosis among gemstone workers in South Africa: Tiger's-eye pneumoconiosis”. Neil W. White MD, FCP(SA), Runjan Chetty FFPath(SA), Dr. Eric D. Bateman MD, FRCP. American Journal of Industrial Medicine. Vol. 9 Issue 2, 1991. https://onlinelibrary.wiley.com/doi/abs/10.1002/ajim.4700190208.

Silicosis risk can be mitigated by adequate ventilation, the wearing of masks and the use of water to dampen down dust. A 2009 report by Reuters attributed silicosis in Guangdong gemstone cutting primarily to unscrupulous subcontracting, with weak oversight and a lack of protective equipment for workers55“Workers risk lung disease cutting gems for jewel trade”. Tan Ee Lyn, Reuters. 16th March 2009.

https://www.reuters.com/article/us-gemstones-lungs/workers-risk-lung-disease-cutting-gems-for-jewel-trade-idUSTRE52F1LR20090316. According to CLB “In the 100 or so cases monitored by CLB, the workers' health tragedies were directly traceable to their employers' disregard of China's occupational health and safety laws and to weak or non-existent enforcement by government agencies56“Deadly Dust”. China Labour Bulletin. Accessed 2nd November 2021. http://gb.clb.org.hk/content/deadly-dust.”

Initiatives have been launched to combat silicosis risk. In 2016, the American Gem Trade Association began a program to provide protective equipment to Indian gemstone workers, with educational pictograph brochures and native-language videos57“Signature Project 1- Enhancing Gemstone Cutting (Pilot area Jaipur, India)”. Gemstones and Sustainable Development Knowledge Hub. Accessed 2nd November 2021 https://www.sustainablegemstones.org/signature-projects/signature-project-1. to inform workers how to prevent dust inhalation and how to use and care for the masks. A study prepared for the American Gem Trade Association by Workplace Health Without Borders in 2019 found that silicosis risk, for those gemstone types it was applicable to, could be largely mitigated by the use of wetting for cutting, shaping and polishing, and remaining risk could be addressed through the use of personal protective equipment58“Jaipur Project: Coloured Gemstones Processing- A Pilot Study for Worker Health Issues and Interventions”. On behalf of WHWB; Paul Bozek, Lissa Ceolin, Marianne Levitsky, Om Malik, Sid Gohil. Prepared for American Gem Trade Association. 8th March 2019. Accessed 2nd November 2021. https://static1.squarespace.com/static/568a3352e0327c02e38c3369/t/5d2062f3397b46000194c322/1562403576448/WHWB+Jaipur+report+8mar2019+final+%281%29.pdf.

Lapidary Women

Any attempt to create economically, socially, and environmentally sustainable futures must consider the position of women. The role of women in society has come to be a focus for governments and corporations, as indicated by initiatives such as the UN Sustainable Development agenda for 2030 to achieve gender equality.

It is difficult to get an accurate idea of how many women are involved in the cutting and polishing of coloured gemstones. A report in 2018 by California-headquartered Business for Social Responsibility on the role of women in the jewellery supply chain found in interviews with stakeholders there was wide variation between the main manufacturing countries59“Women in the Jewelry Supply Chain.” p.31. Chichester, Ouida; Davis Pluess, Jessica; and Momaya, Hetal. White Paper. BSR, San Francisco. 2018.. In Thailand and China, fifty percent of the people working in the industry are women, whereas in India the proportion is thirty percent or even lower. Crucially, “the quality of cutting and polishing jobs varies significantly across factories and geographic regions”. Although some women were working in management positions in sophisticated factories in Thailand or China, women are, overall, more likely to work in informal or domestic workshops or at home, subcontracted by larger factories. Such operations are less likely to be audited or monitored, leaving those working in them more vulnerable.

The report stated that women could be particularly vulnerable not just to the consequences of exploitation but also to problems such as low wages and poor working conditions, which, although they affect men, “may carry additional burdens for women, who tend to have less access to finance, healthcare, education, etc.60“Women in the Jewelry Supply Chain.” Chichester, Ouida; Davis Pluess, Jessica; and Momaya, Hetal. White Paper. BSR, San Francisco. 2018.” Lack of formal employment means that women can become invisible, and may be financially disadvantaged or lack collateral. These factors also contribute to the disproportionate difficulty that women often face in accessing finance to start their own formal businesses, or in borrowing money to purchase equipment.

In Pakistan, where women are forty-eight percent of the population yet make up only nineteen to twenty percent of employees61“Women play key role in country”s development”. The Express Tribune, 28th August 2017. Accessed 2nd November 2021. https://tribune.com.pk/story/1492672/women-play-key-role-countrys-development/, initiatives to bring more women into the skilled workforce have been created, including several gemstone-focused training programmes. The country provides a useful case study for both the challenges and the opportunities facing women in gem processing.

Post-Conflict Emeralds and Female Empowerment

Swat Valley is a region of Pakistan that was occupied by extremist militants from 2007 until 2009. Swat possesses one of the largest deposits of emeralds in Asia62“Gemstone supply chains and development in Pakistan: Analyzing the post- Taliban emerald economy in the Swat Valley”. Muhammad Makkia, Saleem H. Ali b. Centre for International Peace & Stability (CIPS), National University of Sciences & Technology (NUST) Islamabad. Accessed 2nd November 2021. https://www.sciencedirect.com/science/article/abs/pii/S0016718519300053.. The gem-quality emeralds are small but highly prized for their intense, vivid green colour. Swat Valley suffered considerably as a region in conflict, and production from the emerald mines was used to finance insurgent activities.

One effort to overcome the numerous barriers to international trade was to create a brand based on the origin and provenance of Swat Valley gems, to allow for a positive new transparency in the supply chain. This initiative incorporated a focus on the development of skills for women, within what is traditionally a highly patriarchal culture.

Mahmood Alam Mahsud of Fine Cut in Pakistan recognises the value of female empowerment in his company, which employs a 90% female workforce in Islamabad63Interview by video call 24th May 2019. The principle of empowering women through lapidary training and employment has value to jewellery retailers who are eager to make claims to consumers about the positive impact of the gem industry as a vehicle for change. Fine Cut specialise in ‘Swat Valley’ emerald and Mr. Mahsud has created a niche business in Pakistan faceting small, finely calibrated emeralds, cut to internationally-standardised proportions. The founder learned the trade in Thailand and returned to Pakistan with the knowledge of precision cutting to build a business focussed on exporting a locally-produced gemstone cut to a high standard in its country of origin. He exports gems to the UK, Europe, and China.

As His Highness Prince Miangul Aurangezeb, former Crown Prince of Swat State, observed:

“On the one side, the lack of economic opportunities for the local communities is creating frustration and anger against the government and military; on the other side, the unattended situation may lead to militancy, once again [...]. You need to bring the emerald business to its origin, train the locals, and provide them with facilities and skills. To ensure peace, you must ensure sustainable livelihoods for the people of Swat64“Gemstone supply chains and development in Pakistan: Analyzing the post- Taliban emerald economy in the Swat Valley”. Muhammad Makkia, Saleem H. Ali b. Centre for International Peace & Stability (CIPS), National University of Sciences & Technology (NUST) Islamabad. Accessed 2nd November 2021. https://www.sciencedirect.com/science/article/abs/pii/S0016718519300053.”.

Coloured gemstone manufacturing is a process that requires skill, judgement, and highly specialised expertise. It is mechanised and motorised but rarely fully automated. As with mining and trading, this stage of a gemstone’s journey from mine-to-market remains largely traditional, dependent on knowledge and techniques honed over decades and passed between generations. It seems likely this part of the supply chain, as with the others, will always rely heavily on human endeavour.

There are several large manufacturing hubs, or clusters, for coloured gemstone manufacturing, located in places where coloured gemstones are traded. Clusters benefit from craftspeople’s collective, diverse expertise in gemstone varieties and the networks of traders and supporting service-provides that ensure the business of manufacturing can be carried out efficiently and profitably. The whole is greater than the sum of its parts.

Automation is uncommon in coloured gemstone manufacturing, though not unknown. It has been commercialised most extensively and successfully in Guangzhou, which partly explains China’s rapid growth as an international trading and manufacturing hub. Automation relies on a continuous supply of affordable material, lending it to the manufacture of low grade, commercial gemstones of fixed sizes. It is unlikely that automation will spread rapidly to other areas of the coloured gemstone manufacturing industry.

Current gemstone manufacturing clusters in China, India, Sri Lanka and Thailand have grown organically over many years – over generations, in some cases. Laudable recent efforts to establish coloured gemstone manufacturing industries in low-income gemstone-producing countries, including Tanzania and Madagascar, have encountered significant challenges, associated with a lack of skilled craftspeople and a range of underlying social, economic and regulatory factors. Sophisticated, holistic approaches must be adopted to foster commercially-successful new manufacturing hubs, capable of competing with their international peers.

The coloured gemstone manufacturing industry, like any light manufacturing industry, can have associated health, safety, labour, and gender issues that require management, oversight and – in some cases – remediation. A range of initiatives are underway to continually improve practices in the coloured gemstone manufacturing industry, to empower its workers and to provide supporting educational materials and resources such as model policies and procedures for companies to adopt. Improvement efforts are driven by workshops and factories themselves and by industry-led organisations including the Gemstones and Jewellery Community Platform, the Responsible Jewellery Council and CIBJO.

Although the bulk of coloured gemstone manufacture takes place in countries where labour rights protections are low, the available evidence indicates that the most serious labour rights violations – forced labour and child labour – are not widespread. Underage or coerced workers are highly unlikely to have the expertise and professional maturity required for a workshop to succeed.

Silicosis can be a serious risk associated with the manufacture of some gemstones – amethyst, chalcedony and varieties of quartz. However the risk can be fully managed in well-run workshops and the industry is actively working to eliminate lapses and bad practices.

Wages for coloured gemstone cutters and polishers can be several times higher than the local wages of unskilled workers. Great skill and dedication are required to bring out the inner beauty of a coloured gemstone, and those who dedicate their professional lives to this pursuit are rewarded for it.

In the next paper in this series, A Storied Jewel65The Gemstones and Jewellery Community Platform. https://www.gemstones-and-jewellery.com/research/, we explore the journey of a coloured gemstone as it leaves the hands of these craftspeople, and finds its way to a jewellery-maker, a retailer and an end customer.