Mining

Hands That Dig, Hands That Feed:

Lives Shaped by Coloured Gemstone Mining

Introduction

If you were to step back in time to 1880 and enter the sapphire mines along the Himalayas in Kashmir, India, you would see hundreds of workers using basic tools to free valuable gemstones from the rock before passing them hand-to-hand to be washed and sorted ready for market. A little further afield on the valley floor you might find individuals, families or small groups scouring riverbeds in the hopes of finding loose gemstones amongst the gravel.

Across the coloured gemstone world, this picture remains largely the same to this day. Independent diggers, small groups and family businesses comprise the overwhelming majority of workers in the coloured gemstone mining industry. While the sector is sometimes described as fragmented, decentralised, opaque and predominantly illegal, another view is of an industry that comprises many generations of resourceful, resilient businesses that sustain the livelihoods of millions of people in more than fifty countries. The miners behind the great discoveries in gemstone history, such as the Star of India, by and large were not government-backed trading organisations like the East Company or the multinationals of modernity, but rather independent explorers, individual diggers collaborating together, and worker cooperatives.

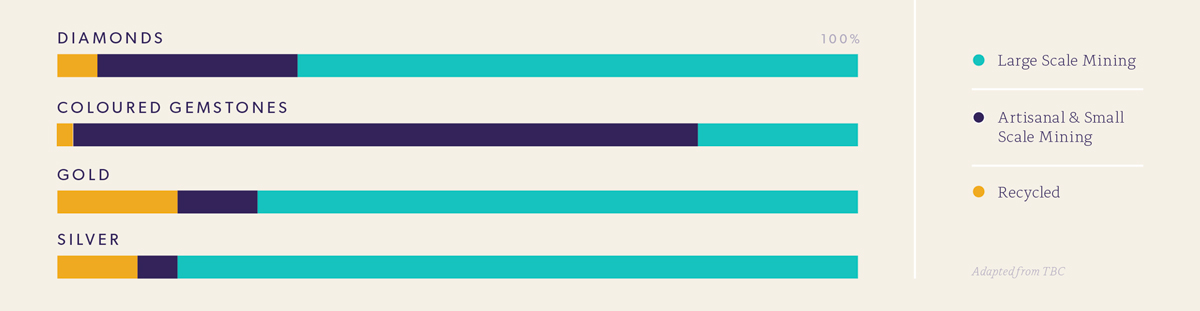

While mining for many metals and commodities like gold and diamonds is now largely a modern, mechanised, internationally-regulated business dominated by large-scale producers, coloured gemstone mining is still the domain of smaller operators – artisanal and small-scale miners working with traditional hand tools and low levels of mechanisation, if any at all. With the exception of one or two high value gemstone types – ruby and emerald for example – there has been no discernible progression.

This unchanging state is largely a result of fundamental mineral economics. Recovering and selling rough coloured gemstones in large volumes has never been considered profitable enough to interest large-scale commercial enterprises or investors. Until now. An increase in both the demand for and the price of some coloured gemstones has caught the eye of entrepreneurs who see the opportunity for high-volume sales based on consistent supply of gem quality material.

Our White Papers are also available to download and read offline.

Please fill in your details to receive a download request.

The growth of responsible sourcing

This period of change in the coloured gemstone mining industry is not only characterised by growing demand and rising prices. Another force is at play. The attention given by regulators and luxury brands to how gemstones are mined, and awareness of the negative environmental and social impacts of poorly-managed operations have been increasing steadily over the last two decades, with significant acceleration in the last five years.

High-profile campaigns by rights groups uncovered, drawing public attention to, serious abuses in the production of gold, tantalum, tin and tungsten originating from high-risk and conflict affected areas, notably the Great Lakes region of Africa. Companies that were already concerned to better understand raw material origins and take action to address issues up their supply chain were shocked. Some withdrew completely from the region which risked worsening the situation. Others chose to remain engaged and be part of the solution.

These campaigns prompted inclusion in the 2010 Dodd Frank Wall Street Reform and Consumer Protection Act in the United States, of articles requiring publicly-listed companies to identify and report the use of the above minerals from the region – spawning growth of a highly competitive industry concerned with mapping and assuring mineral and other raw material supply chains. 1U.S. Securities and Exchange Commission. December 2010. https://www.sec.gov/spotlight/dodd-frank/speccorpdisclosure.shtml Similar legislation came into force in the European Union in January 2021.2 European Commission, Directorate-General for Trade. January 2021. https://ec.europa.eu/trade/policy/in-focus/conflict-minerals-regulation/regulation-explained/ And the coloured gemstone supply chain similarly is beginning to be scrutinised.

While there are some notable exceptions – including Myanmar, see page 39 – it would be a mistake to assume the whole coloured gemstone supply chain is riven with abuses, criminality or environmental risk – or that the majority of gemstones come from high-risk or conflict-affected areas. Of course, some do and there are issues to address, but these do not occur uniformly or universally.

Downstream operators like retailers and manufacturing jewellery brands – understandably – want assurance and have developed voluntary responsible sourcing initiatives designed to take into account social and environmental considerations when managing their relationships with suppliers.3 International Chamber of Commerce. ICC guide to responsible sourcing: Integrating social and environmental considerations into the supply chain. 2008. https://iccwbo.org/content/uploads/sites/3/2008/10/ICC-guide-to-responsible-sourcing.pdf

While large companies are able to meet these requirements, many smaller businesses – especially artisanal and small-scale miners – may lack capacity to meet such demands from companies further downstream in the supply chain.

The coloured gemstone supply chain presents some unique challenges for responsible sourcing – and vice-versa. And how accommodation might be reached while respecting a delicate eco-system that has developed in quite specific ways to survive and thrive over centuries has not been worked out yet entirely.

One thing we do know: the calls for more accountability in mineral supply chains are not getting quieter. Viable solutions for those wishing to prove responsibility, or access certain markets, will be in increasing demand.

The role played by governments

In countries with strong institutional and governance systems, the mining and export of coloured gemstones is largely overseen by government. Mineral rights always belong to governments, and governments issue mining permits. It is through mining ministries and local government offices claims are registered or formalised and competing claims resolved too.

As interest in coloured gemstones rises, governments attempt to capture as much value as possible from mining. Many governments, especially in Africa, are starting to develop capacity to add value, through processing and manufacturing for example, to ensure a greater share of mineral wealth remains in their country. At the same time, many are actively courting large-scale, foreign mining companies with the capital and expertise needed to explore larger deposits leaving some artisanal miners concerned for their future, fearing their way of life is under threat.

New policies around natural resource governance are emerging to shape the industry and its relationship with society. Most governments, where the opportunity exists, pursue formalisation of artisanal and small-scale miners, and the mines they operate, as a first step to capturing more value and ensuring compliance with national laws. Others seek to accommodate large operations and negotiate taxes and royalties for their citizens. Striking a balance that is inclusive, perceived as fair and permits large-scale mining and artisanal mining to coexist can be a challenge. The path taken may lead to a future characterised by conflict, illegality, insecurity and unrest in mining areas at one pole, to a rising tide of prosperity in which mineral wealth lifts the boat for all at the other.

Gemstone mining has cultural, economic, political, social and technical dimensions – we have mined, cut, polished, set in jewellery, bought and sold coloured stones over thousands of years. Yet the gemstone story starts with the geological forces that shaped our billion-year Earth history.

Geology matters to mining

Geological processes determine where coloured gemstones are in the world, and whether they are deposited deep in the Earth or near its surface.

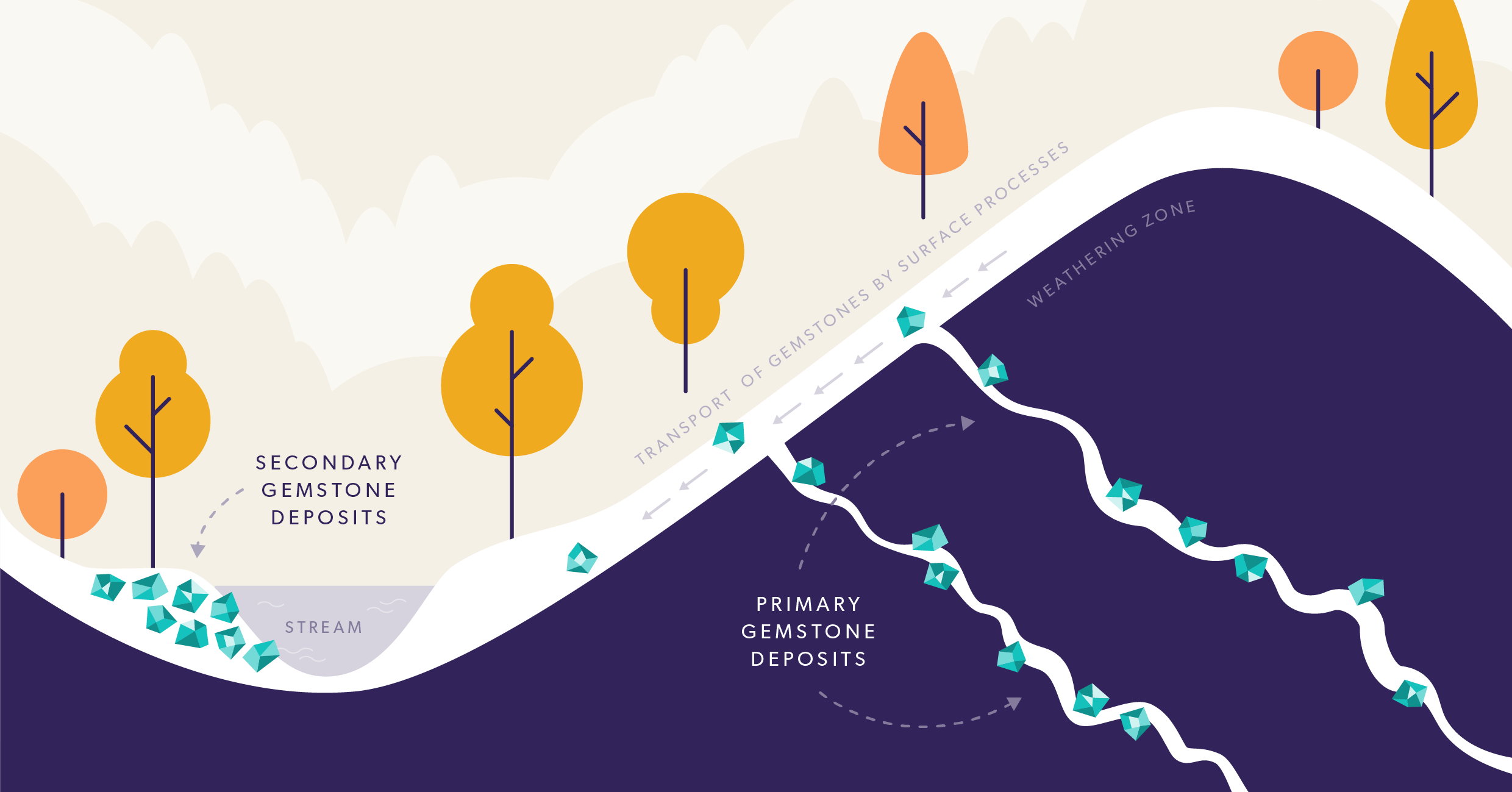

Gemstones can form deep within the Earth’s crust rising to the surface as plate tectonics create and destroy vast mountain ranges and deep oceans. All gemstones have their own unique formation story. Some coloured gemstones force their way to the surface in pockets in or close to magma. Others crystallise in hard bedrock buried deep under the surface. Over millennia, such primary deposits rise slowly or are thrust to the surface where they are exposed to the elements and the gem material released. This can be carried into rivers where it concentrates forming secondary deposits in alluvial sediment.

Geological deposits and geographical spread

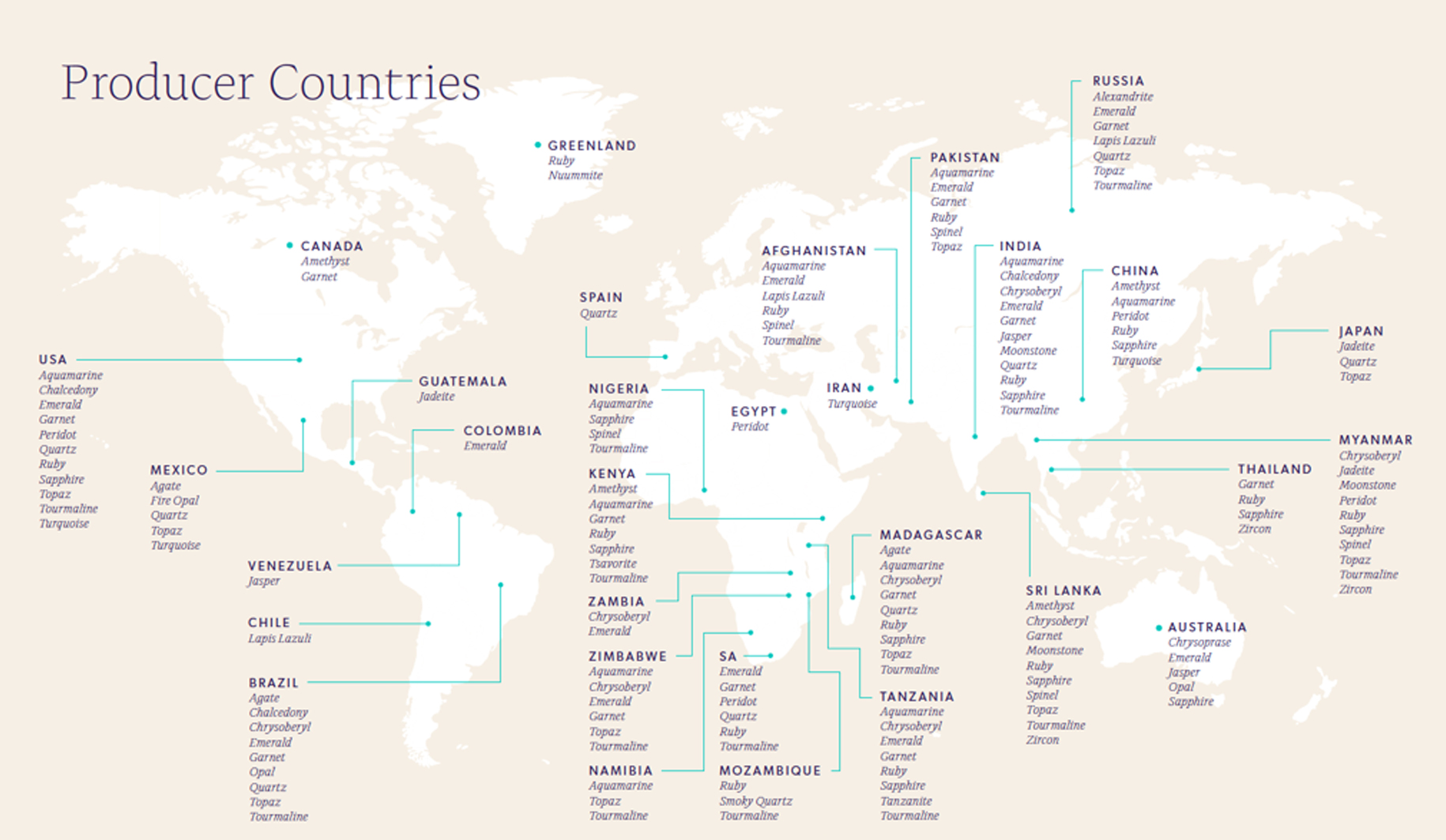

Gemstones can be truly ancient. The rubies of north east Mozambique date back 500 million years, and some Zambian emerald deposits are over one billion years old.4Mapping the gemstone mining hotspots. Mining Technology. 21 May 2018. https://www.mining-technology.com/features/gemstone-mining-map/ Gemstones aren’t easy to find and although coloured gemstones are mined globally, some countries have a disproportionate occurrence. Madagascar supplies 40% of the world’s sapphires. The famous Colombian emerald belt accounts for 25% of the world’s emeralds, its high-quality gemstones representing 50% of the world’s value.5Company walks fine line to revive Colombia emerald mine. Julia Symmes Cobb and Susan Taylor, Reuters. 12 December 2018. https://www.reuters.com/

article/us-colombia-fura-gems-emeralds/company-walks-fine-line-to-revive-colombia-emerald-mine-idUSKBN1OB1LF Thanks to geology, these and other countries have been able to establish themselves as the source of reliable volumes of valuable stones. Key gemstone producing countries such as Brazil, Sri Lanka and Tanzania owe much of their mineral wealth to geology - they are graced with many varieties of coloured gemstones in close proximity and in high concentrations. In countries where gemstone deposits become depleted and mining activity dwindles – such as India and Thailand – the economy has adapted. Certainly, in the case of Thailand, progressive trade policy and legislation has accelerated this adaptation. Gemstone trading, manufacturing and other jewellery-related businesses have developed along with new technologies and traditions, topics that are further explored in the third and fourth papers in this series Oceans Apart? Conventions, Practices and Perceptions in Coloured Gemstone Trading and Wheels of Fortune: The Industrious World of Coloured Gemstone Cutting and Polishing.

Chemical composition determines colour

There are over 200 varieties of coloured gemstone. Each one has a chemical fingerprint of its geological origins that stretches back millions or even billions of years. A few stones are well known. Emerald, ruby and sapphire are three among the so-called “cardinals” of antiquity – diamond, of course, and – perhaps surprisingly – amethyst, until its discovery in Brazil in the 19th century, was also among this select group of gems. There are other gems which have been prized – aquamarine, garnet, spinel, tourmaline and topaz for example – and demand and supply of which has waxed and waned. Then there are relatively new discoveries such as Tanzanite. The spectrum of colours available within a particular variety of gemstone like tourmaline can be impressive. In others, such as aquamarine, variation in colour can be very subtle. The colour of an individual gemstone is determined by its chemical composition and the presence of trace amounts of metal in the crystal lattice. An amethyst gets its colour from iron, as does aquamarine, an emerald from chromium vanadium and a turquoise from copper. Combinations and concentrations of metals that may be unique to one location result in distinct colouration, like Santa Maria aquamarine from Itabira in Brazil, or the distinct and fabled velvety, vivid red of “pigeon blood” ruby from Mogok, Myanmar.

A premium for certain origins

For coloured gemstone miners – and their customers – origin can be important. The value of a Burmese ruby is unequal to that of a Madagascan or Thai ruby, and a deep green Colombian emerald is worth far more than a lighter emerald from Brazil. This is generally because those locations are capable of producing uniquely desirable gemstones that have lore or romance associated with them. Even when others approach or equal them in hue, saturation, size and clarity, gemstones from some locations will always command a premium.

As deposits are depleted, new sources are sought and discovered. Emerging regions in Kenya, Mozambique, Madagascar and Tanzania are becoming more important for aquamarine, garnet, peridot, ruby, sapphire and tourmaline. Ethiopia, already known for its Welo Opal, has recent discoveries of emerald and sapphire that have drawn international attention.

A tradition of exploration

People have mined coloured gemstones since pre-history. There is evidence of emerald mining in Egypt’s emerald region of Sikait-Zabara from at least 500 B.C.6The Ancient Emerald Mines of Egypt. Gemmological Institute of America, Dr James Shigley. 23rd May 2017. https://www.gia.edu/gia-news-research/historical-reading-ancient-emerald-mines-egypt The Romans and Greeks recovered coloured gemstones for their distinctive colours and beauty. Today gemstones are mined in over fifty countries. But before they can be mined, they must first be found. In 1550, the German scholar and mineralogist Georgius Agricola described the skills required in mineral prospecting in De Re Metallica:

“Many persons hold the opinion that the mining industries are fortuitous, and that the occupation is one of sordid toil, and altogether a kind of business requiring not so much skill as labour. But as for myself, when I reflect carefully upon its special points one by one, it appears to be far otherwise. For a miner must have the greatest skill in his work, that he may know first of what mountain or hill, what valley or plain, can be prospected most profitably, or what he should leave alone; moreover, he must understand the veins, stringers and seams in the rocks. Then he must be thoroughly familiar with the many and varied species of earths, juices, gems, stones, marbles, rocks, metals, and compounds. He must also have a complete knowledge of the method of making all underground works.”

Agricola’s description of sixteenth century mining is remarkable for how little this industry has changed since. And despite technology and information revolutions, there is no central source of knowledge for the location of the world’s gemstones. While discoveries can, and frequently do, happen by chance – a farmer tilling a field finds a gemstone – exploration is driven by the desire to find a new variety of gemstone or the next big deposit and is often undertaken by a lone explorer with an entrepreneurial streak or a taste for adventure. They might be locals with traditional knowledge and an instinctive understanding of the landscape, prospectors or gem hunters trained in gemmology, or geologists with advanced mineral exploration skills. Prospecting for lapis lazuli is carried out by local ethnic groups in north- eastern Afghanistan, the peridot mines of the San Carlos Apache reservation in Arizona are explored exclusively by members of the Apache tribe, and the Masai are known for ruby recovered from their ancestral lands straddling the border between Kenya and Tanzania.

Unpredictable by nature

New deposits of coloured gemstone can be discovered during exploration for other minerals. They are occasionally uncovered during construction and civil engineering projects too. Sometimes, indications on the surface or the occurrence of particular chemicals in rock formations suggest the likely presence of gemstones. Explorers look for discolouration that indicates chemical fluids, evidence of fractures and veins that could host gemstones, and favourable rock types such as pegmatites. But finding these clues is no easy task. Unlike other minerals, such as potash or copper which occur in layers or large volumes of relatively consistent grade, the location of gemstones can be unpredictable and constrained to narrow zones. Trial pitting and panning is used to test for the presence of stones in river beds or in surface sediments. This can result in the discovery of a secondary deposit, or be a way to trace the gemstones upstream back to the primary deposit.

The challenges of gemstone exploration

When prospecting for precious metals such as gold, a geologist might assess a sample of rock as containing four grams of gold for every ton of rock. Assessing another sample 100 metres away at five grams of gold per ton suggests the likely presence of a steady concentration of gold at four to five grams per ton over the distance between. Gemstone geologists have no such luxury. Each gemstone's value is unique, dependent on its size, its colour, its degree of inclusions or lack of clarity, depth of colour and other factors. Discovering two gemstones 100 metres apart gives little insight as to the value of other stones that might lie in between.

Larger and better-resourced operators use advanced exploration techniques to define the economic opportunity before they invest further. Geological mapping, aerial ground surveys, geochemical sampling, satellite imagery and geophysical data can identify areas with potential. These techniques also help to ensure that more responsible and efficient mining takes place as determining the optimal type of mining to extract the resource helps governments better manage production.

Where there is promise, explorers use drilling to attempt to build a profile of a resource, creating models of the surface of the deposit and its depth. Knowing the quality of the gemstones when still underground may be near impossible to assess but this kind of exploration may still reveal valuable geological data.

Exploration is, on the whole, highly speculative. This is less of a barrier for artisanal miners who in general rely on local knowledge gained first-hand, from oral tradition or from other artisanal miners. One might also infer larger mining interests are initially attracted to a prospect due to artisanal mining activity or local knowledge shared by landowners or land users. Nevertheless, for large-scale miners and their backers, exploration represents a substantial investment with no guarantee of return.

To recover gemstones from a primary deposit, miners must, in most cases, remove vegetation, soil and rock to access gem-bearing ore. How this is done hasn’t changed significantly for centuries, although techniques are varied and depend on the material and the deposit. Strip mines slice away the land’s surface. Sometimes explosives are used to reach a gemstone vein. Small open pits can reach many metres in depth while large open-cast mines may plummet hundreds. Underground mines tunnel to follow a seam or chambers might be blasted to find a deposit. But over-zealous blasting and crushing of rock risks spoiling the gemstones – and the integrity of the gemstone is everything. That’s why even large gemstone mining operations use hammers and chisels to pry precious gemstones from their host rock once located.

Finding concentrations of gemstone material in gravels on river beds in a mining area presents a lesser challenge. At large-scale mines large earth moving equipment and mechanical buckets can be used to scoop target deposits or high-pressure water jets to loosen and free the gemstone-rich material. Artisanal miners use little more than a pick and a shovel for digging in dry riverbeds and typically will use a sieve to separate rough gems from sediment at the water’s edge. Gemstone-rich gravels can also be run through a screen to remove fine sediment and concentrate the gemstones as in the photograph below.

Once picked, rough gemstones are washed and aggregated - they may be sorted and graded too. Here, water, gravity and human judgement are all heavily relied upon, whereas in larger scale mining this process is likely to be mechanical – see image below.

Artisanal miners—diverse yet not entirely dissimilar

The vast majority of coloured gemstones are dug and scraped from the Earth by small groups of artisanal and small-scale miners using hand tools and limited or no mechanisation. Coloured gemstones from artisanal and small-scale miners are estimated to account for more than 80% of global production.7 Artisanal and Small-Scale Mining. The World Bank. 21 November 2013. http://www.worldbank.org/en/topic/extractiveindustries/brief/artisanal- and-small-scale-mining Take away emerald, ruby, tanzanite and jade and that proportion is nearer 100%.

Supply of Precious Minerals

Large, artisanal and small-scale mining across coloured gemstones, diamonds, gold and silver. (Credit: adapted – TDi Sustainability)8Multiple industry and academic sources and TDi-Sustainability database and analysis. Latest update 2020.

Artisanal miners are highly diverse. They include tight-knit family units and, more recently, groups of women miners who pass knowledge to the next generation; organised community groups mining gemstones as part of a broader livelihood strategy that often includes seasonal agriculture; well-structured profit-sharing cooperatives with formal governance; and small businessmen and entrepreneurs from urban centres. Artisanal miners might also be opportunist transient individuals that group and disband as they move from one deposit to another, or groups that control illegal mine sites. Thanks to their mobility and the near surface availability of many varieties of gemstones, itinerant illegal miners aren’t constrained to one place but can effectively target one discovery and then swiftly move on to the next.

FOCUS ON COLOMBIAN EMERALDS AND THE GREEN WAR

Colombian emeralds are prized for their bright, verdant green colour and have been mined and traded for over a thousand years. They have been continuously fought over as far back as the Spanish conquest of what is now Colombia. At this time, the Spanish seized control of emerald mines from indigenous peoples and held this monopoly until the country’s independence from Spain in 1810. Since then, the Colombian government has alternated between being heavily involved and hands-off in its regulation of the emerald trade.9Emeralds of Colombia. Keller, P.C., Gems and Gemmology. Summer 1981. https://www.gia.edu/gems-gemology/summer-1981-colombian-emeralds-keller In more recent times, emerald wars have been a material part of insecurity in Colombia, overlapping with narcotic cartel wars and leftist insurgencies.

A key figure in the emerald wars was Victor Carranza, Colombia’s so-called ‘emerald czar’ from 1946. By the time of his death in 2013, Carranza controlled 40% of the country’s emerald industry. Through his informal governance structure policed by private security forces, Carranza ensured that emeralds of value were declared to him for selling on to Bogota’s black market. Over time he amassed an empire worth billions of dollars, one that had to be defended against the armed groups and drug cartels who were attracted by the region’s emerald wealth.

The 1980s was a decade of violence in Colombia. Territorial disputes between armed groups and the country’s most powerful mining landowners and families turned into full-blown conflicts in which thousands of people, including civilians, disappeared or were displaced, killed, or kidnapped. Carranza’s reign, however, remained free of any kind external governance and, in general, he opposed the formalisation of Colombia’s emerald sector. This period of Colombia’s history, known as the Green War, came to an end when Carranza used his authority together with that of the Catholic Church to broker a peace deal between the warring factions, a deal that also secured his position within the emerald industry until his death in 2013.10 Victor Carranza. The Economist. 20 April 2013. https://www.economist.com/news/obituary/21576363-v%C3%ADctor-carranza-ni%C3%B1o-colombias- emerald-tsar-died-april-4th-aged-77-v%C3%ADctor-carranza

Carranza’s death marked a turning point for Colombia’s emerald industry and made space for the industry to be restructured, prioritising large-scale, formalised operations and criminalising artisanal guaqueo mining practices. In their time, Carranza’s operations had enabled a reliable livelihood for guaqueo miners, individuals with traditional rights to recover gemstones from the surface, as they were permitted to sift through mine waste to find overlooked gemstones when not searching for them on valley floors. The large companies that replaced Carranza’s operations established more sophisticated systems for sorting mine waste in-house, leaving little to be scoured for secondary material. This restructuring increased traceability of emeralds and transparency of the emerald industry, and brought improved job security and working conditions to those who found employment with the new emerald mining companies. However, it also left miners and traders who had been dependent on guaqueo practices without livelihood.11Peace with Hunger: Colombia’s Checkered Experience with Post-Conflict Sustainable Community Development in Emerald-Mining Regions. Isabel B. Franco,

During the same period, Colombia’s national authorities reformed the mining royalty system. Local governments were now required to apply for funding of specific development projects rather than directly receiving mining proceeds. National policymakers argue that this change, first implemented in 2011, imposes important protections against corruption, and ensures that the money earned from mining is used to further sustainable development. Preliminary results from the new policy, however, indicate significant room for improvement. One report noted that in the Muzo region only one application for funds had been submitted by the local government and, as of February 2018, the project had not been implemented.12Ibid

In the coloured gemstone industry, there often exists a delicate balance between large- and smallscale miners, and the Colombian emerald industry is no exception. Large-scale mining, often seen by governments in countries like Colombia as an opportunity to capture greater value from gemstone reserves, can also threaten the livelihood of community members that have long relied on the guaqueo trade. Conflict between these two kinds of operations, however, is not inevitable. When the dynamics of local communities are carefully considered there may be opportunities for peaceful co-existence between large-scale and small-scale miners.13Ibid

The discovery and recovery of coloured gemstones can be well suited to small operators – operating within the law, at its fringes or entirely outside of it. Harvesting alluvial gravel-bed deposits requires little investment – a simple sieve is all that’s needed – and, when the unit value of the stone is high, can be very profitable. Other deposits might be buried under thick sediment through which miners dig by hand or use a light mechanised excavator or generator and pump to reach layers rich in potential.

Artisanal miners are not dissuaded by depth. Following a discovery, they may tunnel underground with rudimentary equipment, perhaps using a pully, winch and cable to lower tools and even people into mine shafts. The Nova Era emerald deposit in Brazil – located opposite the Belmont mine – was initially worked by a collective of 140 garimpeiros – independent miners – who tunnelled shafts looking for veins leading to large pockets. It is now formalised. Nevertheless, the early days of the deposit witnessed long periods without discovery of gem-quality material, then a single pocket might produce rough worth up to US$10 million.14Mining for Emeralds in Brazil. GIA. 21 July 2014. https://youtu.be/rhWIK_yZ7XA

Artisanal and ‘illegal’ mining

Many artisanal miners do not have title to land or permits to extract minerals. Regulatory frameworks designed for large-scale mining may actually work against their licencing and formalisation.15 Understanding and improving policy and regulatory responses to artisanal and small-scale mining. O’Faircheallaigh & Corbett. November 2016. https:// research-repository.griffith.edu.au/bitstream/handle/10072/100960/O%e2%80%99FaircheallaighPUB2808.pdf?sequence=1&isAllowed=y While many of these people are simply trying to get by, without titles or permits, the sector is categorised as ‘illegal’ mining, even when more gently referred to as ‘informal’.

The legal status of artisanal miners is not, however, a useful distinction. A community of women participating in the relatively benign and peaceful activity of mining tiger’s eye quartz in South Africa’s Northern Cape province is considered illegal as the miners trespass on old abandoned mines. And in Colombia and elsewhere, while there is a world of difference between the armed individuals who plunder from privately-owned mines and the men and women barequeros who collect gemstones from valley floors as they have for decades, both are considered illegal.

In some jurisdictions, however, artisanal miners are protected provided they have permits or agreements with landowners. In Sri Lanka, for example, foreign investment in mechanised mining is not permitted – in fact mechanised mining is strongly discouraged – and its natural resource governance policy supports the growth of nationally-owned mining operations. This policy favours artisanal or small-scale miners who are regulated, monitored and whose production is measured by local agencies, pay their share of taxes and are a recognised part of the gemstone value chain.

A distinction is now often made between ‘illegal’, often itinerant, invasive miners or groups controlled by criminals, sometimes with connivance of corrupt officials, and ‘informal’ community-based mining that typically follows customary laws, although it is important to note that so-called customary laws involving traditional land usage rights, are not necessarily rooted in any formal legal principles.16 Why it doesn’t make sense that all informal mining is deemed illegal. Kgothatso Nhlengetwa, The Conversation. 12 April 2016. http://theconversation.com/ why-it-doesnt-make-sense-that-all-informal-mining-is-deemed-illegal-57237

Over the last two decades, there have been calls for governments to do more to bring into the formal economy unlicenced artisanal miners and informal mine workers. At the International Conference on Artisanal and Small-Scale Mining and Quarrying in Livingstone, Zambia, in September 2018, hundreds of delegates, including artisanal mine owners and operators, concluded the legal status of artisanal miners and their rights to land tenure and sub-surface minerals should be recognised, and that governments should encourage responsible practices and better governance to maximise the positive impacts of the sector. 17 Mosi-oa-Tunya Declaration on Artisanal and Small-scale Mining, Quarrying and Development. Report of the International Conference on Artisanal and Small-scale Mining & Quarrying. 13 September 2018. http://www.developmentminerals.org/index.php/en/resource/studies-handbooks?view=download&id=39&usg=AOvVaw1p2Hwtx2DTTVEkTCB60wic The delegates’ sentiments were summarised in the Mosi-oa- Tunya declaration on artisanal and small-scale mining and quarrying.

THE MOSI-OA-TUNYA DECLARATION

The Mosi-oa-Tunya declaration on artisanal and small-scale mining and quarrying seeks to:

“Affirm that artisanal and small-scale miners and quarry workers must be at the heart of any efforts to transform artisanal and small scale mining, and call on all stakeholders to recognise the initiative and leadership demonstrated by miners and their representatives; actively listen to all issues, concerns and suggestions raised and seek to understand on the ground realities; eliminate any language, discourse and behaviour that worsens the stigma associated with artisanal and small scale mining; and act in a way that empowers miners to chart their own vision of development.”18Ibid

The declaration gives a collective vision for and voiced by artisanal and small-scale mining communities involved in several raw material supply chains, including coloured gemstones. It recognises that while there has been much progress in recognising the legitimacy of this sector, it still faces persistent challenges associated with unclear or unsupportive regulation, poor practices of some operations, and a lack of access to resources and financing and that because of these challenges, the full potential of the sector is not being realised.

The effects of large scale mining

Artisanal mining is ancient. By comparison, mechanised mining for coloured gemstones is in its infancy. And recently, the industry has seen the entry of larger industrial operations, often owned by foreign investors attracted by rising prices and advances in technology. Rough coloured gemstones are estimated to generate US$2-$3 billion annually and consumer interest is growing.

The governance and institutional relationships of these large industrial operations is very different to those of artisanal operators. These large businesses are always formally established entities that negotiate licenses and permits with central government and, in many cases, also answer to boards of directors and shareholders. A handful are publicly-traded and are required by law to disclose data on their operations.

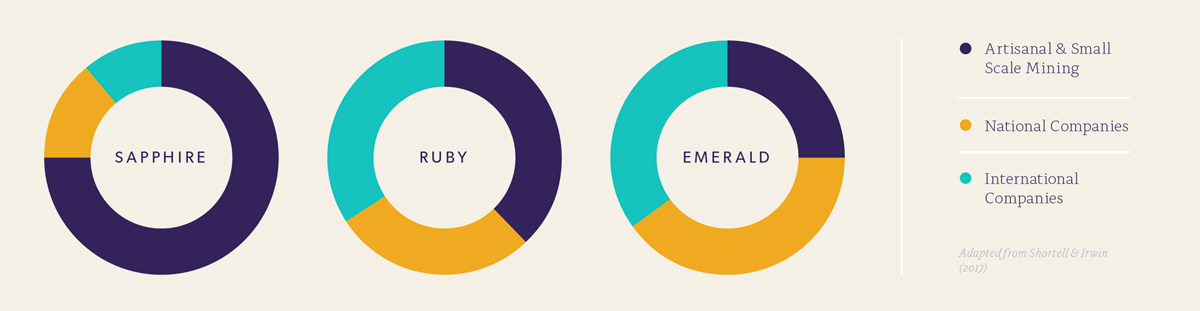

Although there are only a small number of stock market-listed and large-scale mining companies working with a few high-value gemstones, such as ruby, emerald and tanzanite, these companies have managed to capture significant market share.

Industry Break Down of Selected Coloured Gemstones

Adapted from Shortell & Irwin (2017)

Illustrative industry analysis to demonstrate types of mine ownership in different gemstones. (Adapted from Shortell and Irwin, 2017)

Gemfields, an early mover, entered the industry in 2007 and now claims to supply as much as 30% of the world’s emeralds from its Kagem mine in northern Zambia. In 2012, Gemfields acquired the Montepuez site in Northern Mozambique, an area bigger than Malta and the largest known ruby mine in the world today.

Gemfields is not alone. In the emerald industry, Fura Gems, Muzo Companies and Cosquez dominate the Colombian market, and the family run Belmont mine is a significant player in Brazil where the company has been producing for 30 years. In the ruby industry, Danish owned Greenland Ruby has invested in large scale opportunities, starting production 155 miles south of Nuuk, Greenland. In East Africa, TanzaniteOne controls significant tanzanite reserves. The jade mines of Myanmar are heavily mechanised and the country accounts for the vast majority of global production, estimated to be worth billions of dollars.19Governing the Gemstone Sector: Lessons from Global Experience. Paul Shortell and Emma Irwin. Natural Resource Governance Insitute. P. 35. May 2017. https://resourcegovernance.org/analysis-tools/publications/governing-gemstone-sector-lessons-global-experience Although large, these companies are minnows when compared to the behemoth international precious and diversified metals mining houses. Few of them are publicly-listed, and none appear in a list of the world’s top 100 largest mining companies.

Well-capitalised mining companies have the advanced technology and greater mechanisation capabilities that allow them to recover gemstones from primary deposits on a much larger scale and at greater depths than artisanal miners. Operating in large areas gives these companies more options to find the rich concentrations of gemstones. They also typically exploit coloured gemstone deposits through a highly engineered approach, designing open pits or underground mines that more efficiently target higher-grade gemstone-bearing rock. Economies of scale also play a part. As a mining operation grows, the business can spread big costs – like an expensive piece of machinery that will increase the number of gemstones recovered – over the operation’s activities. The result is greater production efficiency. Explosives, pneumatic drilling and heavy machinery are used to recover gemstones from large volumes of rock, tools which smaller mines cannot easily afford.

A concern voiced for and by artisanal miners is that these increases in mechanisation and such vast formal, concessions will inevitably lead to greater and unequal competition for resources and loss of livelihood. There are also fears of displacement if they dig in the area or belong to communities which consider any part of the claim home.

Such fears amongst artisanal miners can be tempered, however. To justify the investment needed to establish an industrial mining operation, companies need continual access to the high volumes of gemstones that only some deposits will offer, as well as a buoyant market. Even if the value of gemstones continues to rise, the viability of large-scale mining will always be constrained by the size and quality of gemstone deposits and the technology available to work them. It is likely there will always be room in the global gemstone supply chain for artisanal and small-scale mining.

The recovery of raw materials cannot be achieved without some adverse impacts, at least in the short term. Most mining, however careful, disturbs plant life, removes soil and rocks, and places pressure on natural habitats. Gemstone mining is no different.

Small groups or individuals recovering gemstones from alluvial deposits can leave a light environmental footprint, but large numbers of itinerant illegal diggers working at unplanned and uncontrolled sites can result in severe ecological degradation. The cumulative effects of multiple small mines can pock-mark a landscape with pits and waste dumps, remove vegetation, drive wildlife away or have lasting negative effects on waterways. For example, hydraulic mining is common in the small-scale exploitation of gemstone deposits from sediments. High pressure water jets are used to break apart the consolidated material and loosen gemstones. If unmanaged, the practice can result in tons of earth transported downstream altering waterways, killing aquatic species and, in some cases, leading to flooding. These disturbances can alter or permanently destroy soil quality in both wildlands and agricultural plots and may also impact underground water resources if not managed carefully.

In extreme cases, the discovery of a new deposit leads to an unmanaged and unmanageable gemstone ‘rush’. Madagascar, a biodiversity hotspot known for its important native species found nowhere else, has experienced several gemstone rushes for amethyst, aquamarine, emerald, ruby, sapphire, topaz and tourmaline, sometimes in or near protected areas or critical ecosystems.

Conservation groups claim that the influx of itinerant workers results in the depletion of local resources as they hunt wild animals for food and deforest large areas to secure wood for fuel and to build shelters and mining infrastructure. If the mining area encompasses forests, ecologically sensitive areas or highly-valued animal or plant species, the impact can be deep and lasting, as has been seen in mining for other minerals. Several conservation groups, including US-based Conservation International,20In Madagascar, Rush for Precious Stones Threatens a Precious Forest. Conservation International. https://www.conservation.org/blog/in-madagascar- rush-for-precious-stones-threatens-a-precious-forest raised the alarm when tens of thousands of illegal sapphire miners settled the makeshift village of Ambodipaiso in Madagascar as a staging place to enter the protected Ankeniheny- Zahamena Corridor. The village grew from 100 to over 10,000 residents in months 21Madagascar Case Study: Artisanal Mining Rushes in Protected Areas and a Response Toolkit. R. Cook and T. Healy, World Wide Fund for Nature. June 2012. https://delvedatabase.org/uploads/resources/ Artisanal-and-Small-Scale-Mining-in-Protected-Areas-and-Critical-Ecosystems- Programme-ASM-PACE-Madagascar-Case-Study-Artisanal-Mining-Rushes- Protected-Areas-and-a-Response-Toolkit.pdf and Conservation International claims that large areas of the national park, famous for its lemurs and other natural treasures, have been converted into scarred, treeless wastelands.22 How illegal mining is threatening imperilled lemurs. National Geographic. 6 March 2019. https://www.nationalgeographic.com/animals/2019/03/ sapphire-mining-fuels-lemur-deaths-in-madagascar/

Others, however, assert that gemstone rushes are short-lived and pose less of a threat to the environment than gold rushes or conversion of natural habitat for agriculture. Vincent Pardieu, a seasoned field gemmologist, who has worked and studied the gem mining areas of Madagascar for decades and has tracked gemstone rushes since 2012, dubs the publicity around the Madagascar sapphire rush ‘fake news.’ 23 Interview conducted with Vincent Pardieu on 26th July 2019. Pardieu points to evidence that forests in the area had been cleared for farming years before the gemstone rush, and to his own data and analysis that shows little or no effect on resident lemurs. Although miners living in remote areas require wood for fires to cook meals and provide warmth, such pressure on forested areas is far less than clearing of land for agriculture. Mining camps also attract followers bringing food with them from the city and preparing meals, and so there is little incentive to hunt for bush game. Pardieu, and others interviewed for this paper, note too that gemstone mining, unlike the process of recovering gold, does not depend on chemicals and is largely done on the surface or in river beds, which are not heavily forested, and so cannot irreversibly damage the landscape. Their argument is that gemstone mining is transitory – mined areas will, therefore, eventually be left to recover – and that the economic advantages to local communities outweigh negative shortterm impacts to the surrounding habitat.

No rigorous environmental impact assessments have been carried out in this area of Madagascar, and drawing conclusions on the state of the forests or the causes of deforestation are problematic at best. Strong opinions are held by conservationists trying to protect valuable biodiversity, but equally by those who work in the industry resisting an anti- mining sentiment that they see as unfairly stigmatising a relatively benign activity that provides for millions. While the impacts of rush mining can be debated in such unregulated contexts where facts are hard to come by, the risks to such unique ecosystems of uncontrolled mining are undeniable. A reason to consider more deeply the role of governance in the sector, a topic that is discussed in greater length in the sixth paper in this series Letting it Shine: Governance in Coloured Gemstone Supply Chains.

Large mining operations using modern technology can be more efficient in the recovery of gemstones but they still generate waste material and can make a considerable dent in the Earth’s surface, especially when open-pit mining is the chosen method. As is noted earlier in this paper, gemstone mining is characterised by the intrinsic uncertainty in the underlying concentration of marketable gemstones. It is not uncommon for 50% or more of the material excavated at a large-scale mine to be non-gem bearing ore that is put aside as waste.24 Market Driven Mine Planning: Optimizing Products Portfolio, Muzo Emerald Mine Case Study. Dr. Enrique Rubio, University of Chile. Mining Planning 2011. 8-10 June 2011, Antofagasta, Chile. And the deeper a mine tunnels to find gemstones, the more waste rock is generated. Where and how this waste material is placed will affect the scale and intensity of the negative impacts it can have on the surrounding environment.

The negative aspects of large-scale gemstone mining are not inevitable, however. In many cases, these can be avoided, managed or remedied where there is the appropriate knowledge, technology and incentive. International best practice addresses mine closure.

A good example is guidance developed by the International Council on Mining and Metals, an international organisation dedicated to a safe, fair and sustainable mining and metals industry. The guidance sets out steps to avoid and remediate environmental harm that can be taken right from the outset when planning an industrial sized mine, and carried through to its closure and eventual de-commissioning.25 Integrated Mine Closure Good Practice Guide. ICMM. 2018. https://guidance.miningwithprinciples.com/integrated-mine-closure-good-practice-guide/ Even though there are few examples of large-scale gemstone mine closure to draw on this practice is being adopted by more and more companies including the Muzo Companies in Colombia.

The Muzo Companies’ mines are located in Western Boyacá region of Colombia, roughly 100 miles north of Bogota. This region has been known for producing fine emeralds since pre-Colombian times. In the 1990s, the region experienced instability and a lack of government control, leading to the encroachment of illegal mining activities and considerable disturbance to the surrounding forests and agricultural lands. In 2013, The Muzo Companies purchased 100% control over the mines and invested tens of millions of dollars into recovering land punctuated with open pits abandoned after decades of illegal mining, implementing a range of environmental projects. It has identified rare and vulnerable reptiles, birds and small mammals and relocated hundreds of individuals to safe zones outside of the mine path, while at the same time executing a training programme for the local community on the importance of protecting biodiversity. The programme focuses on water management, biodiversity protection, land closure and land rehabilitation. In 2018 the company restored three-and-a-half hectares of degraded land to its natural state and planted over 2000 trees, including threatened local species. A special purpose-built nursery was established at the mine to grow the trees used in the reforestation program. Following a policy of continual remediation through the mine life, Muzo Companies applies a technique called hydroseeding – using a high-powered water cannon, a solution consisting of grass seeds, water, fertilizers and wood aggregates is projected onto rock and mine waste dumps resulting in the rapid establishment of a grass-type layer for the recovery of soils in a very short period.

The environmental problems associated with gemstone mining can be severe and certainly should not be ignored, but it would be incorrect to assume they are universal. There is no global assessment of the impacts of coloured gemstone mining – while artisanal and small-scale coloured gemstone mining takes place in more than 50 countries, the available information on its negative impacts is limited and should not be generalised from a small number of uncontrolled rushes. Furthermore, there is a growing body of examples where large-scale miners make substantial investment in environmental management and remediation.

The social consequences of gemstone mining

Coloured gemstone mining, as with all types of mining, can also lead to health, safety and social problems. Mining is dangerous work compounded where operators lack safety knowledge, disregard it or are careless. Tunnels dug too deep and with insufficient support and infrastructure may collapse, trapping workers. Where seasonal tropical rains are heavy, mines can fill with water. In 2008, sixty miners died while trapped in a flooded mine shaft in the Merelani tanzanite mining area in Tanzania.26Tanzania says 16 dead, 49 missing in flooded mine. Reuters. 1 April 2008. https://www.reuters.com/article/idUSL01536739 A decade earlier more than fifty-six drowned in the same area, some 1,000 feet below the surface.27Over 50 dead in Tanzanian mining disaster. BBC news. 14 April 1918. http://news.bbc.co.uk/1/hi/world/africa/77864.stm

Although there are few international health and safety statistics on the coloured gemstone mining industry, there are reports of workplace injuries and fatalities caused by falls into unsecured pits and collapses, accidents with explosives, poorly maintained mechanical equipment, a lack of protective equipment, limited access to emergency services, chronic respiratory illness from dust exposure, malaria, tuberculosis, HIV AIDS, alcoholism and substance abuse.

Human rights groups have drawn attention to child labour at coloured gemstone mines.28 Governing the Gemstone Sector: Lessons from Global Experience. Paul Shortell and Emma Irwin, Natural Resource Governance Institute. May 2017. https://resourcegovernance.org/sites/default/files/documents/governing-the-gemstone_sector-lessons-from-global-experience.pdf; List of Goods Produced by Child Labor or Forced Labor. Bureau of International Labor Affairs, US Department of Labor. Accessed 3rd June 2020. https://www.dol.gov/agencies/ilab/reports/child-labor/list-of-goods The United States Department of Labor lists the gem-producing countries of Angola, the Central African Republic, the Democratic Republic of Congo, Guinea, Liberia and Sierra Leone, and the coloured gemstone-producing countries of India, Tanzania and Zambia among those that use child or forced labour in gemstone production.

Forcing children to work is intrinsically abhorrent, but the presence of children and young adults at a mine site does not always imply that they are working or their labour is forced and hazardous. In some mining zones schools are few and far between, charge fees that cannot be afforded by many, or close half way through the day leaving children unsupervised while their parents work. In such cases, families might prefer to have their children near at hand rather than out of sight and potentially unsafe. Or school graduates, having exceeded the age up to which the local school system is able to offer formal education, might assist or follow their parents at mine sites to earn pocket money by sorting rough stones or even using wages to fund the school fees of younger siblings.

Children are especially vulnerable at mine sites because of the power imbalance that exists between them and the adults around them, but similar power imbalances can also lead to the exploitation of adults.

As with environmental issues associated with gemstone mining, social problems should never be overlooked, but nor should they be considered the norm. Mining is a hazardous occupation and when poorly managed often results in negative outcomes. The allure of ‘quick money’ is said to heighten the risk threshold of individuals, especially when there are few other options for advancement. Yet, these ills are not necessarily inherent consequences – they are often the result of cutting corners, inadequate planning and miscalculation of risk. Things that may be anticipated and avoided.

Mining has always been associated with great wealth. Agricola, writing in 1550, noted:

“Besides, of all ways whereby great wealth is acquired by good and honest means, none is more advantageous than mining; for although from fields which are well tilled (not to mention other things) we derive rich yields, yet we obtain richer products from mines; in fact, one mine is often much more beneficial to us than many fields. For this reason, we learn from the history of nearly all ages that very many men have been made rich by the mines, and the fortunes of many kings have been much amplified thereby.”

How that wealth is distributed in producing countries is equally significant, and is dictated in part by the labour-intensive nature of the industry. Gemstone mining employs many people, and artisanal mining employs the most. It supports the livelihoods of millions of people around the world.

Millions depend on artisanal mining for their livelihoods

Approximately 90% of coloured gemstones are mined in emerging and developing countries.29Colored Gemstones from Mine to Market: Ethical Trade and Mining Certification Challenges. J. C. Michelou. Paper presented at the Rapaport Fair Trade Jewelry Conference, Basel, Switzerland. 18 March 2010. Coloured gemstone mining in certain areas may represent one of very few income opportunities. In Mozambique alone, there are thought to be 100,000 artisanal and small-scale operators extracting gold and coloured gemstones, with a further 1,200,000 ”dependents”.30Global Trends in Artisanal and Small-Scale Mining (ASM): A Review of Key Numbers and Issues, p.7. Morgane Fritz, James McQuilken, Nina Collins and Fitsum Weldegiorgis, The International Institute for Sustainable Development. January 2018. https://www.iisd.org/sites/default/files/publications/igf-asm-globaltrends.pdf In Zimbabwe and in Madagascar, the number is five times higher with 500,000 people involved in artisanal and small-scale mining, and a further 3,000,000 and 2,500,000 dependents respectively – their children and extended family members – benefitting from mining.31Artisanal Mining and Sustainable Development, African Centre for Economic Transformation. 4 July 2018. https://ecdpm.org/app/uploads/ACET-Presentation-Brown-Artisanal-Mining-Sustainable-Development-2018.pdf The figures are similar in Brazil and Colombia; a 2014 estimate put the number of artisanal and small-scale miners at 467,500 and 385,500 respectively. In China, the number has surpassed a million.32Global Trends in Artisanal and Small-Scale Mining (ASM): A Review of Key Numbers and Issues. Morgane Fritz, James McQuilken, Nina Collins and Fitsum Weldegiorgis, The International Institute for Sustainable Development. January 2018. https://www.iisd.org/sites/default/files/publications/igf-asm-global-trends.pdf

How large-scale mining differs

Large-scale mechanised mining employs fewer local people because it relies on automation and qualified technical operators who have to be brought in from overseas. Large-scale operations are typically better able to mitigate many of the health and safety risks associated with mining. Where public and private sector collaborate especially in infrastructure projects, like roadbuilding, and service provision to meet the needs of the mine, such as transport, there is a ‘multiplier effect’ associated with large-scale mining; every job at the mine could equal up to twenty additional jobs in related or dependent sectors. For this multiplier to take effect, strong links have to be forged between the mine and the surrounding economy, something that generally only happens when governments and companies intentionally set out to find and realise such opportunities.33The contribution of the mining sector to socioeconomic and human development (English). McMahon, Gary, Moreira, Susana. Extractive Industries for Development Series No. 30, 87298, World Bank. – Oil, Gas, and Mining Unit Working Paper. April 2014.documents.worldbank.org/curated/en/713161468184136844/The-contribution-of-the-mining-sector-to-socioeconomic-and-human-development Again, Muzo Companies‘ mines in Colombia provide an example.

The Muzo Companies’ mines are located in a region with few opportunities for formal employment and a history of illegal artisanal mining that has left an unskilled population with few choices. As part of their economic integration programme, Muzo Companies started a process to bring as many people as possible into the formal economy. The company hired 800 miners - 70% of which are from the local communities of Muzo and Quipama - under full time employment contracts with salaries attracting two to three times the national legal minimum wage.

It established the Muzo Foundation to deliver development programmes in the community that strengthen local government and build local enterprises to diversify the economy. Although investing in social initiatives is mandated by the Colombian government, Muzo Companies claims to have contributed double the required spend. One example is the creation of Furatena Cacao, a cacao farming operation, incorporating the fermentation of cocoa beans that supports the full value chain from production to marketing. The programme’s objective is to bring education, resources, and support to build viable Fairtrade certified business to the region. In 2018 more than 250 producers participated in the program, achieving their first export to international markets.34Personal communications with Muzo Companies, March to May 2020

Gemstones as a source of tax receipts

In almost all countries, the state is sovereign over its mined minerals. Mining is an opportunity for generation of tax revenues in the form of export duties, royalties and mining licence fees. These receipts may be used for development projects, infrastructure and education.

Setting these taxes – which are collected at point of export – at an appropriate level is a fine balancing act. If they’re too high they might encourage smuggling. If they’re too low, mineral wealth won’t help set the country on the path to inclusive development.

While revenue lost to smuggling without accurate production figures is hard to quantify in the case of artisanal and small-scale mining, Gemfields is able to transparently calculate the principal direct taxes (corporation tax and mineral royalty tax) paid to the governments of Mozambique and Zambia equate to 23 cents and 17 cents of every USD of revenue respectively (equivalent to 23% and 17% of turnover).35 Personal communication with Gemfields. September 2020. “Gemfields has calculated that the principal direct taxes (corporation tax and mineral royalty tax) to the Governments of Mozambique and Zambia equate to 23 cents and 17 cents of every USD of revenue respectively (equivalent to 23% and 17% of gemstone sales revenue). This excludes the benefit of indirect and other taxes (such as taxes on employee salaries, VAT, etc) and the additional expenditure and positive impact of investment in community projects (agriculture, education and healthcare), purchases from local suppliers, skills training and job-creation”.

Table 1 - Comparison of key fiscal terms for company gemstone mining projects in selected countries.36 Data extrapolated from Governing the Gemstone Sector: Lessons from Global Experience, p41. Paul Shortell and Emma Irwin, Natural Resource Governance Institute. May 2017. https://resourcegovernance.org/sites/default/files/documents/governing-the-gemstone_sector-lessons-from-global-experience.pdf

| Country | Commodity & company/ project name (if applicable) | Royalty rate (%) | Corporate income tax rate (%) | State equity participation (%) | State production share (%) | State profit share (%) |

|---|---|---|---|---|---|---|

| Botswana | Diamond (Debswana) | 10 | 22 | 50 | 0 | 80.8 |

| Colombia | Emerald (general) | 1.5 | 25 | 0 | 0 | 0 |

| Malawi | Ruby & Sapphire (Nyala) | 10 | 35 | 10 | 0 | 0 |

| Mozambique | Ruby (Montepuez) | 6 | 32 | 0 | 0 | 0 |

| Myanmar | Jade (general) | 20 | 25 | 0 | 25 | 0 |

| Sierra Leone | Diamond (Koidu) | 6.5 | 25 | 0 | 0 | 10 |

| Tanzania | Tanzanite (TanzaniteOne) | 5 | 30 | 50 | 0 | 50 |

| Zambia | Emerald (Kagem) | 9 | 30 | 25 | 0 | 0 |

Gemstone mining already provides a significant source of revenue for a number of low- and middle income resource-rich nations, and there is strong reason to believe with improved governance of the sector, including more inclusion of artisanal and small-scale miners in the formal economy, tax receipts will increase.

In Tanzania, for example, the annual export value of tanzanite rose dramatically to US$25 million, US$17 million of which from artisanal and small-scale mines, after a large government effort to encourage and support their inclusion in the formal economy.37 Final Report for the Period July 1 2015 to June 30 2016. Tanzania Extractive Industries Transparency Initiative. March 2018. https://eiti.org/sites/default/files/attachments/tanzania-eiti-2015-2016-final-report.pdf

The benefits of mine formalisation

While we don’t know exactly what percentage of production comes from illegal mines – and it varies from region-to-region and country-to-country – it’s safe to assume tax receipts generated from this part of the mining sector will increase when such mines are legally recognised, and workers enter the formal economy.

The benefits of formalisation one would hope will also extend to unlicensed diggers themselves. Participation in the formal economy promises legal protection – of rights and of a livelihood in the case of a personal mining licence – and, one hopes, support to artisanal and small-scale mining communities where there are fears about corruption and attracting criminality.38 Global Trends in Artisanal and Small-Scale Mining (ASM): A Review of Key Numbers and Issues, p XX. Morgane Fritz, James McQuilken, Nina Collins and Fitsum Weldegiorgis, The International Institute for Sustainable Development. January 2018. https://www.iisd.org/system/files/publications/igf-asm-global-trends.pdf

It should improve health and safety outcomes and reporting of accidents, and makes possible in principle monitoring, oversight and enforcement of the national mining code and all applicable laws.

While formalisation certainly promises benefits it is worth noting a poorly implemented formalisation and taxation reform process can without other vital reforms, and an even hand, create further – sometimes unanticipated – problems, excluding large numbers of people leaving them without livelihood.

In Africa, Tanzania has blazed a trail in artisanal and small-scale mining policy, starting in 1997. In the intervening years, it has sought to make improvements to national regulation of licensing and land access, and passed the 2010 Mining Act to establish a citizen mining license:

“A ‘primary mining license’ for citizen mining, defined as requiring less than USD 100,000 in investment and a tenure of five to seven years. Procedures for obtaining a primary mining license are less demanding than those for a regular or special mining license, although they do require applicants to conduct an environmental and social investigation of the proposed site. The licenses are granted by Zonal Mines Officers rather than the Commissioner for Minerals in Dar es Salaam.”39Governing the Gemstone Sector: Lessons from Global Experience, p28. Paul Shortell and Emma Irwin, Natural Resource Governance Institute. May 2017.

These specialised regulations for artisanal miners represent an important and promising accomplishment, but their implementation has been challenging. Tensions and rivalries remain. Uptake has not been universal. While the 2010 Mining Act provided for over 2,000 square kilometres of land to be reserved for artisanal and small-scale mining, a move which aims to “allow the state to more efficiently target technical assistance, including geological mapping, the introduction of efficient techniques, and training on safety and environmental standards”, as well as financial support from the Tanzanian government,40Governing the Gemstone Sector: Lessons from Global Experience, p28. Paul Shortell and Emma Irwin, Natural Resource Governance Institute. May 2017. https://resourcegovernance.org/sites/default/files/documents/governing-the-gemstone_sector-lessons-from-global-experience.pdf conflict between large-scale projects and artisanal and small-scale miners persists.

In the areas surrounding the TanzaniteOne mine, the largest tanzanite concession, the operators of the mine have grown frustrated with continual encroachment by independent diggers who don’t respect the concessions boundaries. A fence has been built to keep them out. Meanwhile the diggers complain the TanzaniteOne project prevents them access to the richest tanzanite concessions.41Ibid.

Other experts have noted the mining planning process remains tightly controlled by central government, with local government and communities largely left out of decision-making about the governance of mining concessions and the use of mining revenues to address community needs.42Artisanal and small-scale mining in Tanzania – Evidence to inform an ‘action dialogue’. Willison Mutagwaba, John Bosco Tindyebwa, Veronica Makanta, Delphinus Kaballega and Graham Maeda. July 2018. https://pubs.iied.org/pdfs/16641IIED.pdf

So, while formalisation holds promise for some communities, unlicenced cooperatives and individuals, it isn’t a panacea. Its success relies on well-executed, well-thought-out policies and broader reforms that don’t incentivise illegality. A theme we pick up in the last paper in the series Letting it Shine: Governance in Coloured Gemstone Supply Chains.

FOCUS ON THE JADE MINES OF MYANMAR

In terms of both export value and gem quality, Myanmar’s coloured gemstone riches are virtually unparalleled. The country provides an estimated 90% of the world’s jade, along with a significant portion of rubies, sapphires and other stones to the global market.43Danger and desperation in Myanmar’s jade mines. Andrew Nachemson. November 2020. https://www.thethirdpole.net/en/livelihoods/danger-and-desperation-in-myanmars-jade-mines/ Sadly, much of this natural resource wealth has brought far more harm than good to the people of Myanmar. In previous eras, Myanmar’s jade from Kachin State has been used to fund both sides of a civil war, and has helped to finance luxurious lifestyles for one of the world’s most oppressive military dictatorships. Over the past quarter of a century, large-scale mines, backed by the dictatorship, moved to consolidate the industry and ramp up production, cutting out the ecosystem of small-scale producers from surrounding communities.44 Data taken from the Global Witness film Jade and the Generals. Global Witness. https://www.globalwitness.org/en/campaigns/myanmar/jade-and-generals/ Where artisanal miners are still involved in the process, it is often as scavengers, digging through the rubble left behind by large-scale operations. This livelihood is not only meagre and insecure, but dangerous: every year, many people are killed by landslides on the steep slopes, and heroin use is common, even among teenagers.45 Myanmar’s deadly ’jade rush’. Soe Soe Htoon, BBC News, 13th September 2019. https://www.bbc.co.uk/news/av/world-asia-49678063/myanmar-s-deadly-jade-rush

Since beginning its transformation to democracy in 2011, there has been hope of a turnaround within Myanmar’s jade industry. It is clear that, if managed properly, jade resources could be a windfall for the people of Myanmar and provide the opportunity to fund equitable economic development. As a Global Witness report argued:

“Global Witness estimates that the value of official jade production in 2014 alone was well over the US$12 billion indicated by Chinese import data, and appears likely to have been as much as US$31 billion. To put it in perspective, this figure equates to 48% of Myanmar’s official GDP and 46 times government expenditure on health.”46Jade and the Generals. Global Witness. https://www.globalwitness.org/en/campaigns/myanmar/jade-and-generals/;

Yet, this potential seems to have gone largely unrealised, and corruption is often cited as a significant causal factor. Many international watchdog NGOs and industry experts, including a recent report by the Extractive Industries Transparency Initiative (EITI), raised serious concerns about the level and persistence of government graft associated with Myanmar’s coloured gemstone operations.

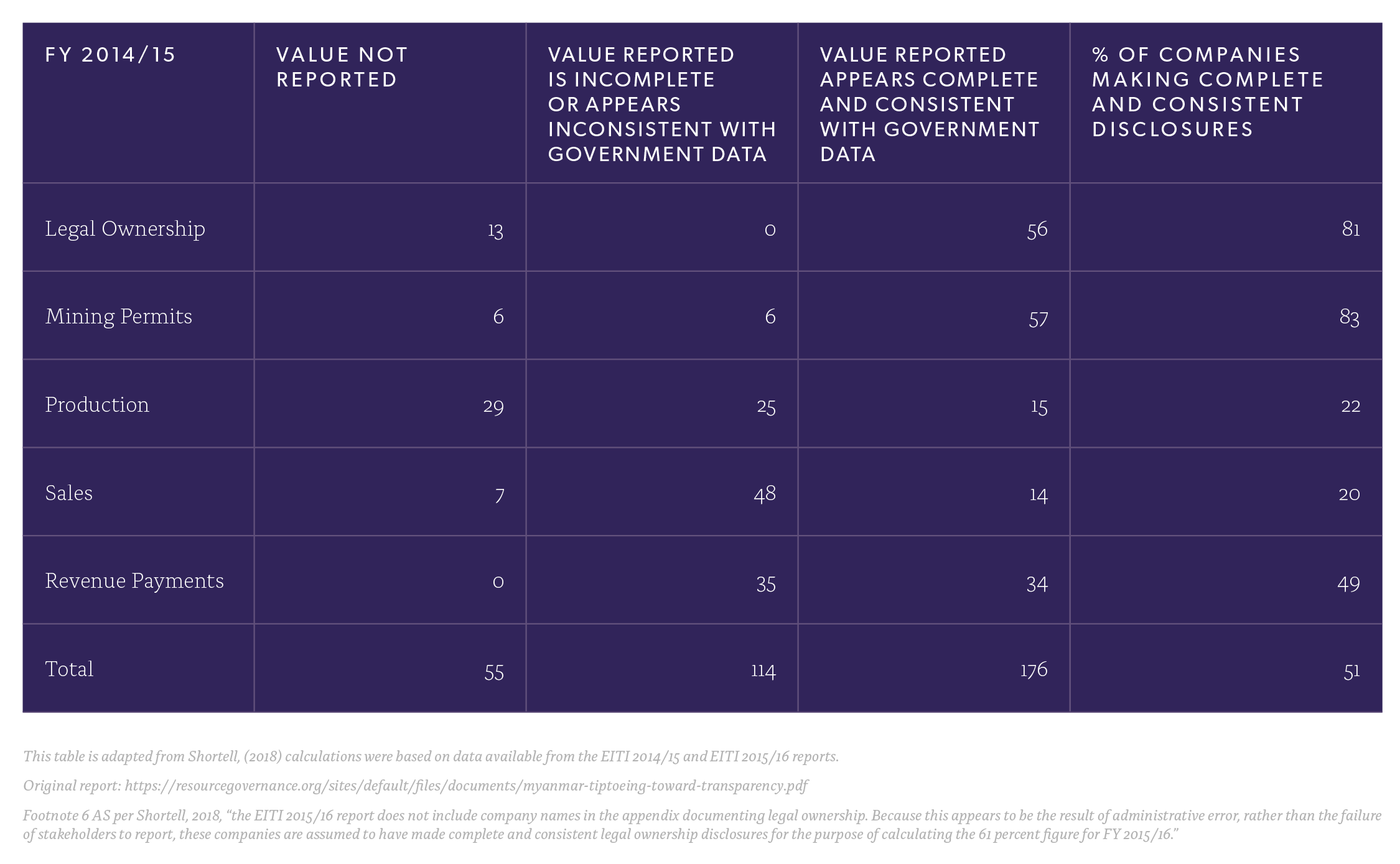

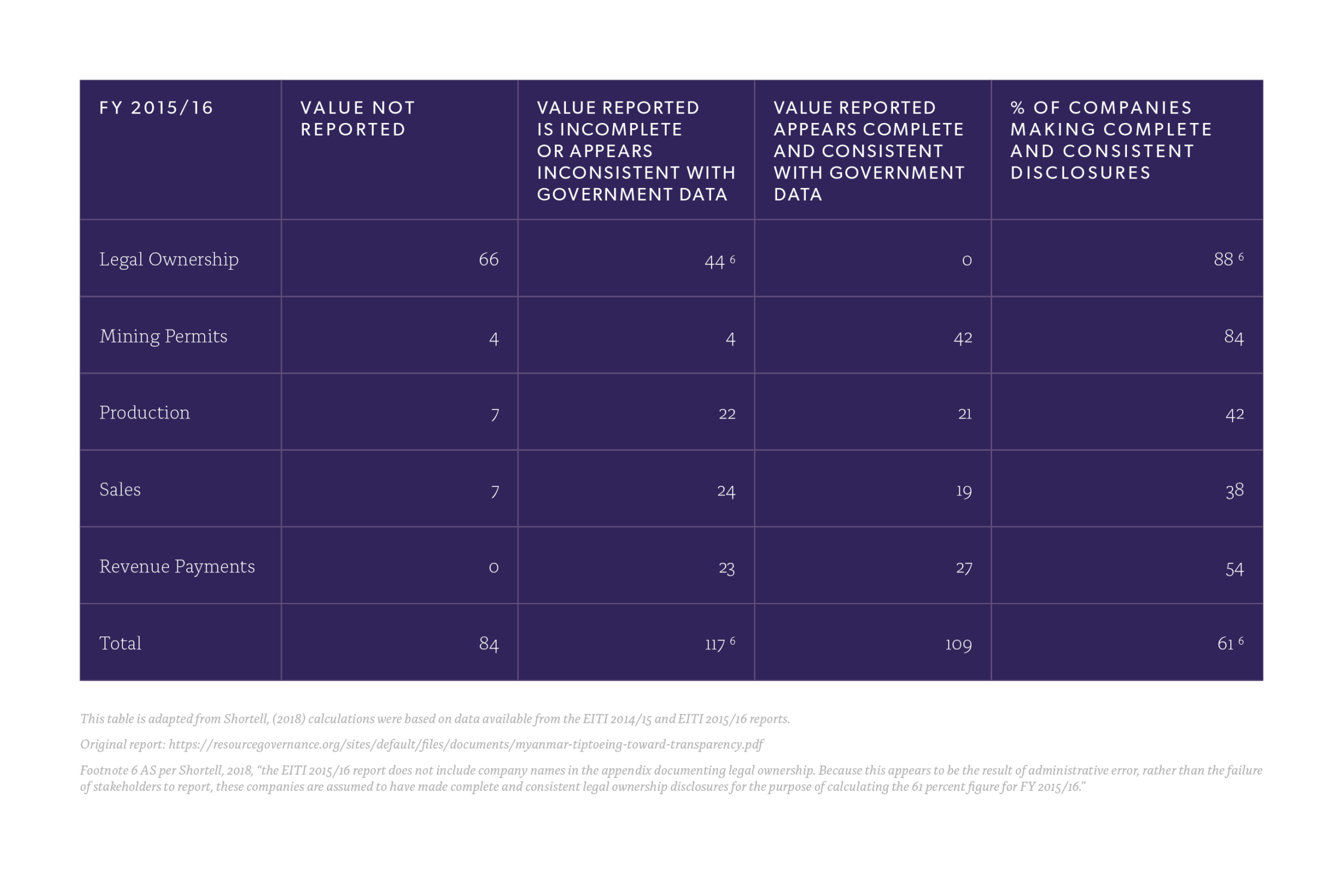

For example, the fact that Myanmar has disclosed data — including information on jade and gemstone ownership, mining permitting and production, and gemstone sales — about its mining industry seems a positive step. However, experts have found that the data it disclosed on virtually all of these issues was problematic. Specifically, one report stated that, “Nearly half of jade and gemstone companies’ data shared from financial years 2014/15 and 2015/16 were missing, incomplete or irreconcilable with government data.”47Tip-Toeing Toward Transparency: Jade and Gemstone Sector Disclosures in Myanmar, p2. Natural Resource Governance Institute. 13 December 2018. Archived version available at: https://web.archive.org/web/20190724043346/https://resourcegovernance.org/sites/default/files/documents/myanmar-tiptoeing-toward-transparency.pdf These discrepancies can easily be seen in the table below. And while the percentage of companies “making complete consistent disclosures” regarding legal ownership went from 81% in financial year 2014/2015 to 88% in 2015/2016, there were no cases in which the values that companies reported were consistent with government data. A lack of consistent data collection and measuring systems is likely the cause of problematic data.

Table 2. Levels of proper disclosure by jade and

gemstone businesses in Myanmar in 2014/15, based on EITI data.48Table adapted from Tip-Toeing Toward Transparency: Jade and Gemstone Sector Disclosures in Myanmar, p.3. Paul Shortell. Natural Resource Governance Institute. December 2018. Archived version available at: https://web.archive.org/web/20190724043346/https:/resourcegovernance.org/sites/default/files/documents/myanmar-tiptoeing-toward-transparency.pdf

Table 3. Levels of proper disclosure by jade and gemstone businesses in Myanmar in 2015/16, based on EITI data49 Table adapted from Tip-Toeing Toward Transparency: Jade and Gemstone Sector Disclosures in Myanmar, p.3. Paul Shortell. Natural Resource Governance Institute. December 2018. Archived version available at: https://web.archive.org/web/20190724043346/https:/resourcegovernance.org/sites/default/files/documents/myanmar-tiptoeing-toward-transparency.pdf Calculations based on data available from the EITI 2014/15 and EITI 2015/16 reports.

Ownership of the jade mining operations, and the distribution of mining revenue, is another possible reason for the benefits failing to raise economic conditions locally. Based on the available data it seems that many coloured gemstone mines, jade mines in particular, are controlled by Chinese investors and government officials.50Myanmar EITI Gemstone Sector Review. Irwin, Emma. Natural Resource Governance Institute. July 2016. https://www.resourcedata.org/dataset/rgi-myanmar-eiti-gemstone-sector-review/resource/9e5c6104-89e2-4160-93c6-425293a5e6a2 ; and Jade: Myanmar’s“Big State Secret”. Global Witness. 23rd October 2015.https://www.globalwitness.org/en/campaigns/oil-gas-and-mining/myanmarjade/ Mining is regulated by the Myanmar Gems Enterprise (MGE), the government’s state-owned enterprise, whose monitoring and enforcement responsibilities are unclear, and whose staff is largely comprised of retired military personnel, as is the case with most government institutions in Myanmar.51Ibid, pg. 7.

Furthermore, MGE’s mandate is unclear as it includes both regulation of the industry as well as operation of joint mining ventures throughout the country, a clear conflict of interest.52Governing the Gemstone Sector: Lessons from Global Experience, p35. Paul Shortell and Emma Irwin, Natural Resource Governance Institute. May 2017. https://resourcegovernance.org/sites/default/files/documents/governing-the-gemstone_sector-lessons-from-global-experience.pdf With systemic corruption in government, weak government institutions and legislative and regulatory frameworks, and poor enforcement mechanisms, and with gemstone resources and commercial operations mostly in the ownership of an opaque elite, the possibility for jade mining to benefit the citizens of Myanmar seems remote.

Despite inherent problems, efforts to address challenges are underway. For example, a new national gemstone policy has recently been developed through an extensive participatory multistakeholder consultation process supported by international technical assistance. This policy aims to align the governance of the gemstone sector with international good practice standards and the principles of sustainable development. The country’s commitment to implement the EITI Standard53For more information about the EITI Standard, visit https://eiti.org/collections/eiti-standard

also ensures ongoing dialogue and efforts towards continuous improvement in terms of transparency and governance of the sector. Furthermore, an active and engaged civil society network is increasingly participating in reform efforts, putting pressure on key players to implement reforms. The extent to which these key reform activities will have visible and measurable benefits in the short to medium term remains unclear. They are, however, certainly planting important seeds of change that will ideally deliver necessary longer-term changes.

Author’s note: Myanmar reverted to military rule following a coup d’état on 1st February, 2021. It is unclear the impact this will have on the initiatives referenced above.

The benefits of good governance

Both artisanal and small-scale and large-scale gemstone mining bring benefits. Artisanal mining provides jobs for millions of people and facilitates the continuation of traditions that span multiple generations. It provides a livelihood for people who might have few choices, in some of the poorest places on the planet. Large scale operations in coloured gemstone mining bring capital, mechanisation and more efficient and productive mines, and a government revenue much needed in many host countries. Getting the best out of coloured gemstone mining requires good governance to ensure that artisanal miners are brought inside the formal economy, that revenues from larger operators are collected, and that the benefits of this fundamentally important industry support positive development outcomes.

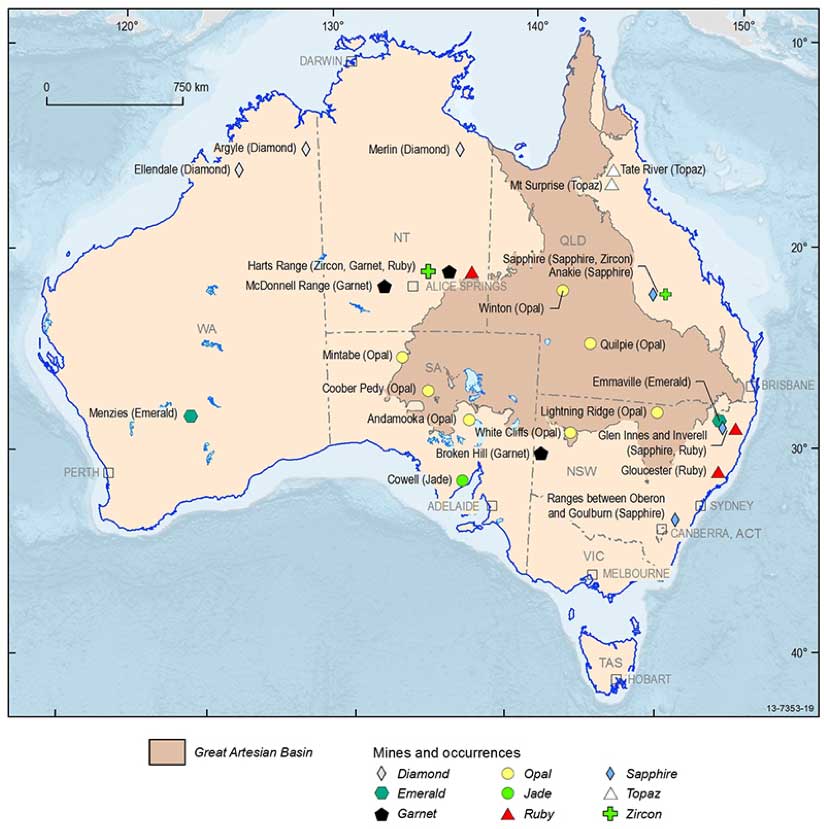

FOCUS ON REGULATION IN AUSTRALIA

Australia has developed ways to regulate a mining sector that comprises many different types and sizes of operations, ranging from the largest corporate entities to tourists searching for souvenirs. Australia – both at the national level and through its states and territories – has designed effective legislation to govern all of these different mining activities, regardless of the scale or type. As a result, they co-exist harmoniously.

Because of the varying terrain across Australia, as well as the range of gemstone varieties recovered, the methods that miners use can differ widely between operations. In the Kings Plains national park of New South Wales, for example, gems are mined at some concessions via open pit mechanised commercial production, and in other places with jackhammers and hand shovels.54Australian Mineral Facts: Sapphire and Ruby. Geoscience Australia – Australian Government. https://np.ga.gov.au/education/classroom-resources/minerals-energy/australian-mineral-facts/sapphire The juxtaposition of large and small is even more pronounced in Queensland’s gem-mining area. Here large-scale projects operate alongside recreational ‘fossicking’ – a kind of small-scale surface digging by enthusiastic treasure-seeking individuals with hand tools.

While it is common for medium- and large-scale miners to be properly regulated,55 Regulations for these mid- and large-scale projects are different from those governing fossicking, but are just as rigorous. See Mining and Quarrying Safety and Health Regulation 2017, State of Queensland. https://www.legislation.qld.gov.au/view/pdf/inforce/current/sl-2017-0166 countries that effectively regulate small-scale miners are scarce. Australia is an exception. Even for recreational fossicking, there are regulations for the kinds of mining tools and methods that are permitted, environmental protections, proper licensing, and the requirement to respect the property and rights of other miners.56Fossicking Regulation 2009, State of Queensland. https://www.legislation.qld.gov.au/view/pdf/inforce/2017-07-01/sl-2009-0167 Queensland’s fossickers, many of whom are tourists, are only permitted to mine in designated areas. On these smaller deposits, the amount of mining is restricted by not allowing large-, or even medium-scale mining activities. These restrictions ensure that small gemstone reserves can be sustained long-term, rather than being exhausted rapidly by industrial techniques.57 Seeking the Legacy of Australian Sapphire. Tao Hsu, Andrew Lucas and Vincent Pardieu, GIA. 14 December 2015. https://www.gia.edu/gia-news-research/seeking-legacy-australian-sapphire Similarly targeted regulation for opal mining in New South Wales restricts this to mechanised underground mining and does not allow artisanal digging. Other states allow open-pit mining and ‘noodling’ – or small-scale mining – of some deposits.58 Australian Mineral Facts: Opal. Geoscience Australia – Australian Government. https://np.ga.gov.au/education/classroom-resources/minerals-energy/australian-mineral-facts/opal

Source: Geoscience Australia, Australian Government. Accessed at www.ga.gov.au

This carefully segmented regulatory approach works well for Australia. The rules governing the sector clearly signal what kind of mining is allowed where, and what requirements there are for each mining method. This helps prevent confusion and disagreement over who has the right to occupy or mine any given deposit.59In Queensland, for example, the government maintains maps which specify the kinds of mining that are permitted. See Fossicking Regulation 2009, State of Queensland. https://www.legislation.qld.gov.au/view/pdf/inforce/2017-07-01/sl-2009-0167.

“Each state’s Mineral Resources Development Act declares certain areas official fossicking areas; therefore, no prospecting and mining licenses are issued there for businesses or corporations. The authors were amazed by the harmony between the miners and fossickers in areas where fossicking zones are right next to mining claims. To help people locate their targets, many private and government websites provide maps and detailed guidance. Local mineral and gem clubs also host events as a platform for fossickers to communicate and possibly exchange items.” 60Gem Fossicking: Recreational Mining in Australia. Tao Hsu, Andrew Lucas and Vincent Pardieu, GIA. 16 December 2016. https://www.gia.edu/gia-news-research/gem-fossicking-recreational-mining-australia